Production Theory

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Production Theory as PDF for free.

More details

- Words: 1,313

- Pages: 6

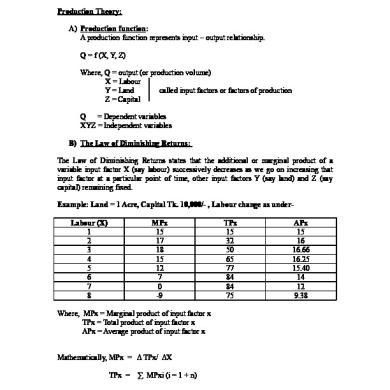

Chapter- 04: Production Theory Production Theory: A) Production function: A production function represents input – output relationship. Q = f (X, Y, Z) Where, Q = output (or production volume) X = Labour Y = Land called input factors or factors of production Z = Capital Q = Dependent variables XYZ = Independent variables B) The Law of Diminishing Returns: The Law of Diminishing Returns states that the additional or marginal product of a variable input factor X (say labour) successively decreases as we go on increasing that input factor at a particular point of time, other input factors Y (say land) and Z (say capital) remaining fixed. Example: Land = 1 Acre, Capital Tk. 10,000/- , Labour change as underLabour (X) 1 2 3 4 5 6 7 8

MPx 15 17 18 15 12 7 0 -9

TPx 15 32 50 65 77 84 84 75

APx 15 16 16.66 16.25 15.40 14 12 9.38

Where, MPx = Marginal product of input factor x TPx = Total product of input factor x APx = Average product of input factor x Mathematically, MPx = Δ TPx/ ΔX TPx =

∑ MPxi (i = 1 + n)

MPx is the additional product produced by one additional unit of input factor X. TPx is the sum of all MPx.

Figure: MPx, TPx and APx 100 80 60

MPx

40

TPx Apx

20 0 -20

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Relationship between MPx and TPx: TPx is the sum of all MPx, that is TPx = ∑ MPxi When MPx > 0 then TPx increases. When MPx < 0 then TPx decreases. When MPx = 0 then TPx is at its maximum. Q. Why does the law of work (or function) in real time? Ans. In every production function there exists an optimal input factor ratio to get the optimal output. Return to scale: a. Increasing returns to scale b. Constant returns to scale c. Decreasing returns to scale a. Increasing returns to scale- denotes a situation whereby a proportional increase in all input factors leads to a more-than-proportional increase in output. b. Constant returns to scale- denotes a situation whereby a proportional increase in all input factors leads to the same proportional increase in output. c. Decreasing returns to scale- denotes a situation whereby a proportional increase in all input factors leads to a less- than-proportional increase in output.

Example: Situation-1: Input Land : 1 acre Labour : 3 Capital: Total Tk 10,000/-

Output Q= 50 monds paddy

Situation-2: Let us increase all input factor by 100% or two times Input Output Land : 2 acre Q= 110 or 90 Labour: 6 or 100 monds Capital: Total Tk 20,000/paddy

When Q = 110; This is the case of increasing returns to scale. When Q = 90; This is the case of decreasing returns to scale. When Q = 100; This is the case of constant returns to scale. Isoquant: (Iso- equal, quant- quantity) An isoquant represents equal amount of output that can be produced from different combinations of two input factors. Slope of isoquant = MRTS= MPx/MPy (MRTS- Marginal Rate of Technical Substitution) Isocost: (means equal cost) An isocost shows equal amount of cost that a firm can incur from purchase of different combinations of two input factors. Slope of isocost = Px/Py Figure: Isoquant

Figure: Isocost

Least –cost or optimal input combination: Two conditions need to be satisfied here: (a) Necessary condition: slope of isoquant = slope of isocost MPx/MPy

=

Figure:

Px/Py

(b) Sufficient condition: MPx/Px = MPy/ Py Graphically in point of tangency of an isoquant to the isocost line. Higher levels of combination show higher levels of output. Hence Q3 > Q2 > Q1 Chapter- 5: Cost Concepts, Relationships & Practical Applications

A. Fixed & variable cost concepts: Fixed costs are those costs that do not change with changes in output levels. Example: Rent, Insurance premium, Depreciation of building etc. Variable costs are those costs that do change (vary) with changes in output levels. Example: Raw materials cost, Direct wages. Figure: TFC Curve

Figure: TVC Curve

TFC = Total Fixed Cost TVC = Total Variable Cost TC = TFC + TVC AC = TC/Q AFC = TFC/Q AVC = TVC/Q AC = AFC + AVC MC = Δ TC/ ΔQ Marginal principal is a very important principle in economics B. Direct & indirect costs: Direct costs are those costs that can be calculated per product or per process unit. Example: Direct raw material costs, Direct wages etc. Indirect costs are those costs that can not per calculated per product or process unit Example: Rent, Utility bills, Depreciation etc. C. Explicit & Implicit costs: Explicit costs are cash expenses (or expenses paid on cheques) Example: Salary, Wages, Raw material costs etc. Implicit costs are non-cash expenses. Example: Depreciation, Opportunity cost etc. D. Sunk cost: Sunk costs are irrecoverable expenses that is, these are expenses incurred that can’t be recovered in future. Example: Lottery ticket money when the lottery is lost, non-refundable tender bid money when the tender is lost. E. Marginal & Incremental costs:

Marginal cost is the additional cost for one additional product unit. MC = TC/ Q Incremental cost is the additional cost associated with implementation of one additional management decision. Example: If IIUC management decides to open a new department then the additional cost associated with the opening of a new department will be called incremental cost. F. Opportunity costs: Opportunity cost is the potential benefit foregone (lost) from the next best decision alternative. The basic principal of opportunity cost is ‘if we do one things then we have to give something else up’. Opportunity cost is the potential benefit foregone from the alternative given up. The life involves trade offs. Example: Opportunity cost of Tk 100.00 million of Jb. K. A. Habib Investment opportunity Return on investment alternative Fisheries 25% Flower cultivation 30% Fruit cultivation 35% Meat processing 45%

Ranking iv. iii ii i

Remarks

Next best Best

A rational investment will go for the best alternatives. In our example case the meat processing investment decision is right. G. Economic & Accounting cost concepts: Fixed and variable cost concepts, direct and indirect cost concepts are accounting cost concept. Explicit and implicit, marginal and incremental, and opportunity cost concepts are economic cost concepts. Long- Run Total Cost (LRTC) Curves: In the long-run there is nothing called fixed cost. That is, all costs are variable in the long-run

A.

B.

Figure: LRTC Curve showing increasing Figure: LRTC Curve showing decreasing returns to scale returns to scale In this case Q > C. In this case Q < C Rate of change output is greater than the rate of Here, rate of change output is smaller than change input.

the rate of change input.

C.

D.

Figure: LRTC Curve showing constant Figure: LRTC exhibiting variable returns to returns to scale. scale The rate (or percentage) increase or This figure initially exhibits increasing decrease in output is equal to the rate (or returns to scale and after certain output percentage) increase or decrease in cost. level (Q*) level, it exhibits decreasing returns to scale. E.

Figure: LRTC exhibiting variable returns to scale. This figure initially exhibits decreasing returns to scale and after certain output level (Q*) level, it exhibits increasing returns to scale. Relationships between MC, AVC, AC and AFC curves: MC curve is U-shaped. And again MC curve determines the shapes of AVC and AC curves. Hence both AVC and AC curves are also U-shaped Figure: MC, AVC, AC and AFC curves AC = AFC + AVC AC > AVC

MC must cut both AC and AVC curve at the bottoms (or lowest points) from below. AFC curve is hyperbola. That means, it goes on decreasing as output is increased. AFC continuously decreased. It never cut the both X and Y axis. Its value never be zero.

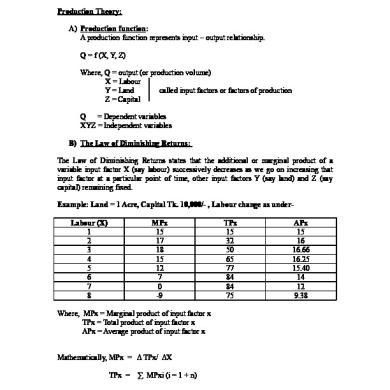

MPx 15 17 18 15 12 7 0 -9

TPx 15 32 50 65 77 84 84 75

APx 15 16 16.66 16.25 15.40 14 12 9.38

Where, MPx = Marginal product of input factor x TPx = Total product of input factor x APx = Average product of input factor x Mathematically, MPx = Δ TPx/ ΔX TPx =

∑ MPxi (i = 1 + n)

MPx is the additional product produced by one additional unit of input factor X. TPx is the sum of all MPx.

Figure: MPx, TPx and APx 100 80 60

MPx

40

TPx Apx

20 0 -20

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Relationship between MPx and TPx: TPx is the sum of all MPx, that is TPx = ∑ MPxi When MPx > 0 then TPx increases. When MPx < 0 then TPx decreases. When MPx = 0 then TPx is at its maximum. Q. Why does the law of work (or function) in real time? Ans. In every production function there exists an optimal input factor ratio to get the optimal output. Return to scale: a. Increasing returns to scale b. Constant returns to scale c. Decreasing returns to scale a. Increasing returns to scale- denotes a situation whereby a proportional increase in all input factors leads to a more-than-proportional increase in output. b. Constant returns to scale- denotes a situation whereby a proportional increase in all input factors leads to the same proportional increase in output. c. Decreasing returns to scale- denotes a situation whereby a proportional increase in all input factors leads to a less- than-proportional increase in output.

Example: Situation-1: Input Land : 1 acre Labour : 3 Capital: Total Tk 10,000/-

Output Q= 50 monds paddy

Situation-2: Let us increase all input factor by 100% or two times Input Output Land : 2 acre Q= 110 or 90 Labour: 6 or 100 monds Capital: Total Tk 20,000/paddy

When Q = 110; This is the case of increasing returns to scale. When Q = 90; This is the case of decreasing returns to scale. When Q = 100; This is the case of constant returns to scale. Isoquant: (Iso- equal, quant- quantity) An isoquant represents equal amount of output that can be produced from different combinations of two input factors. Slope of isoquant = MRTS= MPx/MPy (MRTS- Marginal Rate of Technical Substitution) Isocost: (means equal cost) An isocost shows equal amount of cost that a firm can incur from purchase of different combinations of two input factors. Slope of isocost = Px/Py Figure: Isoquant

Figure: Isocost

Least –cost or optimal input combination: Two conditions need to be satisfied here: (a) Necessary condition: slope of isoquant = slope of isocost MPx/MPy

=

Figure:

Px/Py

(b) Sufficient condition: MPx/Px = MPy/ Py Graphically in point of tangency of an isoquant to the isocost line. Higher levels of combination show higher levels of output. Hence Q3 > Q2 > Q1 Chapter- 5: Cost Concepts, Relationships & Practical Applications

A. Fixed & variable cost concepts: Fixed costs are those costs that do not change with changes in output levels. Example: Rent, Insurance premium, Depreciation of building etc. Variable costs are those costs that do change (vary) with changes in output levels. Example: Raw materials cost, Direct wages. Figure: TFC Curve

Figure: TVC Curve

TFC = Total Fixed Cost TVC = Total Variable Cost TC = TFC + TVC AC = TC/Q AFC = TFC/Q AVC = TVC/Q AC = AFC + AVC MC = Δ TC/ ΔQ Marginal principal is a very important principle in economics B. Direct & indirect costs: Direct costs are those costs that can be calculated per product or per process unit. Example: Direct raw material costs, Direct wages etc. Indirect costs are those costs that can not per calculated per product or process unit Example: Rent, Utility bills, Depreciation etc. C. Explicit & Implicit costs: Explicit costs are cash expenses (or expenses paid on cheques) Example: Salary, Wages, Raw material costs etc. Implicit costs are non-cash expenses. Example: Depreciation, Opportunity cost etc. D. Sunk cost: Sunk costs are irrecoverable expenses that is, these are expenses incurred that can’t be recovered in future. Example: Lottery ticket money when the lottery is lost, non-refundable tender bid money when the tender is lost. E. Marginal & Incremental costs:

Marginal cost is the additional cost for one additional product unit. MC = TC/ Q Incremental cost is the additional cost associated with implementation of one additional management decision. Example: If IIUC management decides to open a new department then the additional cost associated with the opening of a new department will be called incremental cost. F. Opportunity costs: Opportunity cost is the potential benefit foregone (lost) from the next best decision alternative. The basic principal of opportunity cost is ‘if we do one things then we have to give something else up’. Opportunity cost is the potential benefit foregone from the alternative given up. The life involves trade offs. Example: Opportunity cost of Tk 100.00 million of Jb. K. A. Habib Investment opportunity Return on investment alternative Fisheries 25% Flower cultivation 30% Fruit cultivation 35% Meat processing 45%

Ranking iv. iii ii i

Remarks

Next best Best

A rational investment will go for the best alternatives. In our example case the meat processing investment decision is right. G. Economic & Accounting cost concepts: Fixed and variable cost concepts, direct and indirect cost concepts are accounting cost concept. Explicit and implicit, marginal and incremental, and opportunity cost concepts are economic cost concepts. Long- Run Total Cost (LRTC) Curves: In the long-run there is nothing called fixed cost. That is, all costs are variable in the long-run

A.

B.

Figure: LRTC Curve showing increasing Figure: LRTC Curve showing decreasing returns to scale returns to scale In this case Q > C. In this case Q < C Rate of change output is greater than the rate of Here, rate of change output is smaller than change input.

the rate of change input.

C.

D.

Figure: LRTC Curve showing constant Figure: LRTC exhibiting variable returns to returns to scale. scale The rate (or percentage) increase or This figure initially exhibits increasing decrease in output is equal to the rate (or returns to scale and after certain output percentage) increase or decrease in cost. level (Q*) level, it exhibits decreasing returns to scale. E.

Figure: LRTC exhibiting variable returns to scale. This figure initially exhibits decreasing returns to scale and after certain output level (Q*) level, it exhibits increasing returns to scale. Relationships between MC, AVC, AC and AFC curves: MC curve is U-shaped. And again MC curve determines the shapes of AVC and AC curves. Hence both AVC and AC curves are also U-shaped Figure: MC, AVC, AC and AFC curves AC = AFC + AVC AC > AVC

MC must cut both AC and AVC curve at the bottoms (or lowest points) from below. AFC curve is hyperbola. That means, it goes on decreasing as output is increased. AFC continuously decreased. It never cut the both X and Y axis. Its value never be zero.

Related Documents

Production Theory

May 2020 21

Production Theory And Estimation

June 2020 17

Theory Of Production

April 2020 12

Production

October 2019 46

Production

October 2019 43

Production

June 2020 17More Documents from ""

Production Theory

May 2020 21

Islami Song

June 2020 20

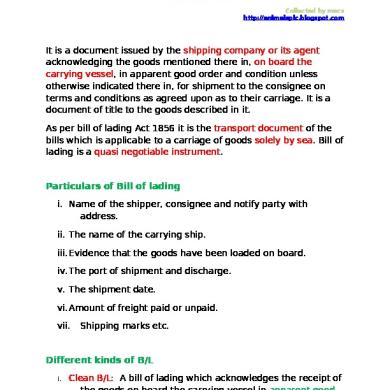

Bill Of Lading

July 2020 19

Incentives For Exporters

July 2020 27

Managing Marteing Channels

May 2020 0