Incentives For Exporters

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Incentives For Exporters as PDF for free.

More details

- Words: 320

- Pages: 2

Incentives for exporters Collected by macs http://animalspic.blogspot.com

To promote the export business, Government has declared some incentives for exporter. Following are the main incentives declared by the ministry of commerce. 1.

Retention Quota: Exporters are allowed to keep 40% of their export proceeds to their F.C. account. It is 7.5% in case of export against which import is higher, proportionately.

2.

Investment period: Normally export fiancé, as working capital is allowed for 180 days. Now it has been extended up to 270 days for frozen foods. Tea & Leather.

3.

Credit card: Exporters are allowed to get credit cares for business tour.

4.

Investment facility: Commercial banks may fiancé for export, up to 90% of FOB value of the export L/C

5.

No compensation: Commercial banks will not impose compensation on overdue sight export bill under irrevocable export L/C.

6.

Tax at source: Exporters are allowed to pay only 0.25% tax on the export value at source.

7.

Duty draw back: Those exporters, who are not availing bonded ware house facility, are entitled to get duty draw back facility. They will pay the duty to the custom authority at the time of importing the raw materials and after realization of the export proceeds, they will apply for draw back the duty paid earlier. Authority will pay back the duty.

8.

Bonded ware house facility: 100% export oriented industries are allowed to import duty free goods for ultimate export. The goods to be stored at the bonded ware house.

9.

Duty free capital machinery: 100% export oriented industries outside EPZ are also allowed to import capital machineries free of duty.

10. Cash

incentives: Deemed exporters are allowed 25% cash

incentive by Bangladesh Bank. 11. Stock

lot disposal: Rejected Garments & Leather may be sold

to local marked paying 20% duty on the imported raw materials. 12. Freight

rebate: Bangladesh Biman charging freight at a

reduced rate for fruit & vegetable export.

To promote the export business, Government has declared some incentives for exporter. Following are the main incentives declared by the ministry of commerce. 1.

Retention Quota: Exporters are allowed to keep 40% of their export proceeds to their F.C. account. It is 7.5% in case of export against which import is higher, proportionately.

2.

Investment period: Normally export fiancé, as working capital is allowed for 180 days. Now it has been extended up to 270 days for frozen foods. Tea & Leather.

3.

Credit card: Exporters are allowed to get credit cares for business tour.

4.

Investment facility: Commercial banks may fiancé for export, up to 90% of FOB value of the export L/C

5.

No compensation: Commercial banks will not impose compensation on overdue sight export bill under irrevocable export L/C.

6.

Tax at source: Exporters are allowed to pay only 0.25% tax on the export value at source.

7.

Duty draw back: Those exporters, who are not availing bonded ware house facility, are entitled to get duty draw back facility. They will pay the duty to the custom authority at the time of importing the raw materials and after realization of the export proceeds, they will apply for draw back the duty paid earlier. Authority will pay back the duty.

8.

Bonded ware house facility: 100% export oriented industries are allowed to import duty free goods for ultimate export. The goods to be stored at the bonded ware house.

9.

Duty free capital machinery: 100% export oriented industries outside EPZ are also allowed to import capital machineries free of duty.

10. Cash

incentives: Deemed exporters are allowed 25% cash

incentive by Bangladesh Bank. 11. Stock

lot disposal: Rejected Garments & Leather may be sold

to local marked paying 20% duty on the imported raw materials. 12. Freight

rebate: Bangladesh Biman charging freight at a

reduced rate for fruit & vegetable export.

Related Documents

Incentives For Exporters

July 2020 27

The Exporters

October 2019 13

Marketing And Branding For African Exporters

May 2020 6

Hr Incentives

June 2020 21

Fiscal Incentives

December 2019 26

Incentives Prez

November 2019 47More Documents from "api-3832224"

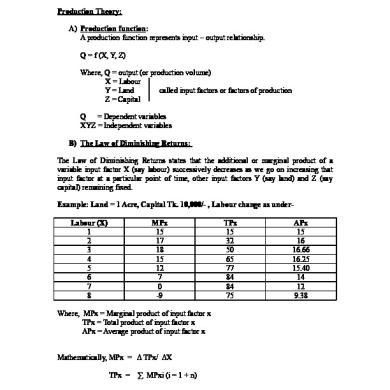

Production Theory

May 2020 21

Islami Song

June 2020 20

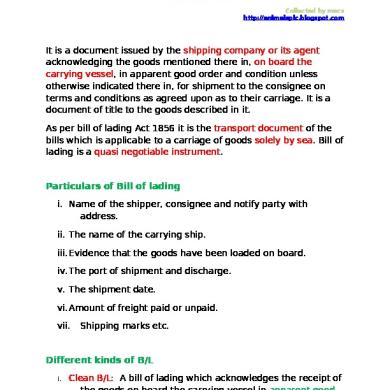

Bill Of Lading

July 2020 19

Incentives For Exporters

July 2020 27

Managing Marteing Channels

May 2020 0