Micro Insurance And Takaful

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Micro Insurance And Takaful as PDF for free.

More details

- Words: 842

- Pages: 26

Microinsurance and Takaful/Cooperative combinations 1 st Asian C onfe rence on Mic roinsura nce July 2 5-2 6 2 007

Overview of presentation • • • •

About ICMIF Overview of the cooperative and mutual sector Microinsurance through cooperatives Opportunities and need for microtakaful

About ICMIF • • • • •

Established in 1922 180 members from 70 countries 22 Takaful members Not-for-profit, voluntary and member driven Regional offices in Brussels, Tokyo, Tunis & Washington • Represents 11% of total global premiums

Cooperative definition “A cooperative is an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointlyowned and democratically controlled enterprise”

Source: International Cooperative Alliance (ICA)

Cooperative/mutual values • • • • •

Self-help, self-responsibility Democracy, equality, equity Solidarity Honesty, openness Social responsibility, caring for others

Cooperative vs. Mutuals Cooperative principles

Mutual principles

Open and voluntary membership

Free association

One member, one vote

User must be member

Limited interest on shares

"Not for profit”

For the benefit of user-members

Quality products

Cooperative education

Personal development

Cooperation among cooperatives

Solidarity

Why a cooperative/mutual?

Cooperatives and Mutuals: the hidden giants of the world economy The largest 300 cooperatives and mutuals have a turnover of 1 trillion USD

ESTIMATES

Worldwide importance of mutual insurers, 2001 Percent o f t otal p remiums 100% = 2416 bio USD

USA

32

EUR

25

CAN

JAP

KOR

Source:

Swiss Re for worldwide total premium; ICMIF

21 19 16 14

Providing microinsurance The challenges • • • • • • • • • •

Coverage Regulation Moral hazard and Fraud Adverse selection Education and trust Technical expertise Affordability Retention Sustainability Penetration

Potential for cooperatives to provide microinsurance • History of organising the poor • Operate for the interest of members by members • Trust • Ownership and loyalty • Peer pressure • Surplus reinvested or redistributed

Cooperatives providing microinsurance • • • • •

CARD MBA – The Philippines Sanasa Insurance Company – Sri Lanka Centre D’Innovation Financiere – West Africa Columna - Guatemala Torreon - Mexico

Challenges for microinsurance cooperatives • Regulatory requirements • Accessing reinsurance • Technical and financial investment

The way forward?

• • • •

Maintain informal operations Merge with other providers Enter into a partner-agent agreement Lobbying regulators

Microtakaful: Opportunities and need

Pri nci ple s of Takaf ul • • • • •

Solidarity and joint guarantee Self reliance and self sustaining for community well being Assist those that need assistance Community pooling system Shari’ah approved investments and products “Bear ye one another’s burden”

The Globa l Takaf ul s ector • • • •

1979 First Takaful Company established 1996 – 30 Institutions transacting Takaful 2002 – 50 Takaful operators and four Retakaful providers 2004 – 80 Takaful operators, 200 Takaful windows and 12 Retakaful providers

Source: IBB Solicitors, UK – (2005)

The need for mi crotakaf ul • • • • • •

Social services inadequate or unavailable Large sectors of poverty in many Muslim countries Over half of world’s lowest developed countries have a majority Muslim population Increasing inequality in Middle East and Gulf countries Religious considerations are important in villages and small communities Established Takaful sector neglecting low income sector

“A noticeable lack of microinsurance in North Africa and the Middle East. In no other region is the absence of microinsurance so evident” Source: The Landscape of Microinsurance (The Microinsurance Centre)

“Ta kaful i s t he se cond most important so cia l in st itu tion t o counter pove rt y and d epriva tion” 1999

Omar Fi scher

“A cooperative and mutual scheme providing Shari’ah approved products and investments is permissible under Islamic Law”

Possi bi lities for microtakaf ul • Establish community based microtakaful schemes • Involvement of NGOs, zakat funds, donor agencies • Support from Takaful sector Technical expertise Financial assistance Partner-agent model

Mi crota kaful in pr acti ce • • • •

Agricultural Mutual Fund - Lebanon Amana Takaful – Sri Lanka Takaful Ikhlas Takmin - Indonesia

The case of a microtakaf ul pol icyhol der • Ibu Iwit, 50 years, farmworker, earning one dollar a day. • Took out a 6 month loan of 55 USD from local Baitul mal Wat Tamwil • Insurance premium was taken out with Takmin at 0.16 USD • Ibu Iwit passed away a couple months later • Her husband, Amad, age 60 years, no income • Outstanding loan paid off by Takmin

Summary • • • • • •

Cooperatives have for many years being providing insurance to the underserved population. There is a need to find avenues to facilitate the sustainable growth of the informal sector operators. The philosophy and principles of Takaful are similar to cooperatives. Takaful requires the needy to be given protection. There is a need for microtakaful in many Muslim and NonMuslim countries to support poverty alleviation efforts. The Takaful sector is now firmly established and can start looking at providing access for the poorer communities.

A Global reach for local strength Thank you

www.takaful.coop

Overview of presentation • • • •

About ICMIF Overview of the cooperative and mutual sector Microinsurance through cooperatives Opportunities and need for microtakaful

About ICMIF • • • • •

Established in 1922 180 members from 70 countries 22 Takaful members Not-for-profit, voluntary and member driven Regional offices in Brussels, Tokyo, Tunis & Washington • Represents 11% of total global premiums

Cooperative definition “A cooperative is an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointlyowned and democratically controlled enterprise”

Source: International Cooperative Alliance (ICA)

Cooperative/mutual values • • • • •

Self-help, self-responsibility Democracy, equality, equity Solidarity Honesty, openness Social responsibility, caring for others

Cooperative vs. Mutuals Cooperative principles

Mutual principles

Open and voluntary membership

Free association

One member, one vote

User must be member

Limited interest on shares

"Not for profit”

For the benefit of user-members

Quality products

Cooperative education

Personal development

Cooperation among cooperatives

Solidarity

Why a cooperative/mutual?

Cooperatives and Mutuals: the hidden giants of the world economy The largest 300 cooperatives and mutuals have a turnover of 1 trillion USD

ESTIMATES

Worldwide importance of mutual insurers, 2001 Percent o f t otal p remiums 100% = 2416 bio USD

USA

32

EUR

25

CAN

JAP

KOR

Source:

Swiss Re for worldwide total premium; ICMIF

21 19 16 14

Providing microinsurance The challenges • • • • • • • • • •

Coverage Regulation Moral hazard and Fraud Adverse selection Education and trust Technical expertise Affordability Retention Sustainability Penetration

Potential for cooperatives to provide microinsurance • History of organising the poor • Operate for the interest of members by members • Trust • Ownership and loyalty • Peer pressure • Surplus reinvested or redistributed

Cooperatives providing microinsurance • • • • •

CARD MBA – The Philippines Sanasa Insurance Company – Sri Lanka Centre D’Innovation Financiere – West Africa Columna - Guatemala Torreon - Mexico

Challenges for microinsurance cooperatives • Regulatory requirements • Accessing reinsurance • Technical and financial investment

The way forward?

• • • •

Maintain informal operations Merge with other providers Enter into a partner-agent agreement Lobbying regulators

Microtakaful: Opportunities and need

Pri nci ple s of Takaf ul • • • • •

Solidarity and joint guarantee Self reliance and self sustaining for community well being Assist those that need assistance Community pooling system Shari’ah approved investments and products “Bear ye one another’s burden”

The Globa l Takaf ul s ector • • • •

1979 First Takaful Company established 1996 – 30 Institutions transacting Takaful 2002 – 50 Takaful operators and four Retakaful providers 2004 – 80 Takaful operators, 200 Takaful windows and 12 Retakaful providers

Source: IBB Solicitors, UK – (2005)

The need for mi crotakaf ul • • • • • •

Social services inadequate or unavailable Large sectors of poverty in many Muslim countries Over half of world’s lowest developed countries have a majority Muslim population Increasing inequality in Middle East and Gulf countries Religious considerations are important in villages and small communities Established Takaful sector neglecting low income sector

“A noticeable lack of microinsurance in North Africa and the Middle East. In no other region is the absence of microinsurance so evident” Source: The Landscape of Microinsurance (The Microinsurance Centre)

“Ta kaful i s t he se cond most important so cia l in st itu tion t o counter pove rt y and d epriva tion” 1999

Omar Fi scher

“A cooperative and mutual scheme providing Shari’ah approved products and investments is permissible under Islamic Law”

Possi bi lities for microtakaf ul • Establish community based microtakaful schemes • Involvement of NGOs, zakat funds, donor agencies • Support from Takaful sector Technical expertise Financial assistance Partner-agent model

Mi crota kaful in pr acti ce • • • •

Agricultural Mutual Fund - Lebanon Amana Takaful – Sri Lanka Takaful Ikhlas Takmin - Indonesia

The case of a microtakaf ul pol icyhol der • Ibu Iwit, 50 years, farmworker, earning one dollar a day. • Took out a 6 month loan of 55 USD from local Baitul mal Wat Tamwil • Insurance premium was taken out with Takmin at 0.16 USD • Ibu Iwit passed away a couple months later • Her husband, Amad, age 60 years, no income • Outstanding loan paid off by Takmin

Summary • • • • • •

Cooperatives have for many years being providing insurance to the underserved population. There is a need to find avenues to facilitate the sustainable growth of the informal sector operators. The philosophy and principles of Takaful are similar to cooperatives. Takaful requires the needy to be given protection. There is a need for microtakaful in many Muslim and NonMuslim countries to support poverty alleviation efforts. The Takaful sector is now firmly established and can start looking at providing access for the poorer communities.

A Global reach for local strength Thank you

www.takaful.coop

Related Documents

Micro Insurance And Takaful

May 2020 18

Takaful

October 2019 32

Takaful

May 2020 23

Micro Insurance Compilation

November 2019 9

Micro Insurance Project Report

June 2020 9

Micro Insurance Project Marketing)

June 2020 13More Documents from "celine 15"

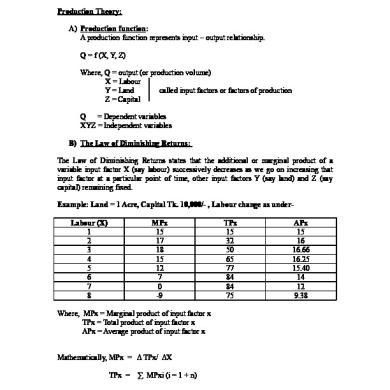

Production Theory

May 2020 21

Islami Song

June 2020 20

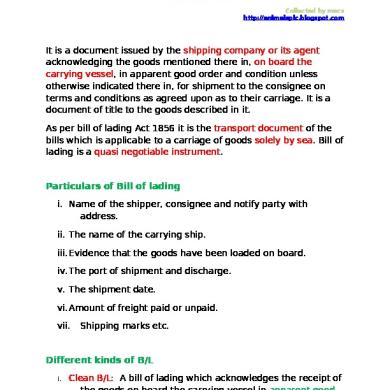

Bill Of Lading

July 2020 19

Incentives For Exporters

July 2020 27

Managing Marteing Channels

May 2020 0