Ibf Course Outline Apr08

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Ibf Course Outline Apr08 as PDF for free.

More details

- Words: 295

- Pages: 2

SHAHEED ZULFIKAR ALI BHUTTO

INSTITUTE OF SCIENCE & TECHNOLOGY Plot # 67 Street # 9 Sector H - 8/4 Islamabad Tell # 92 – 051 – 4445480

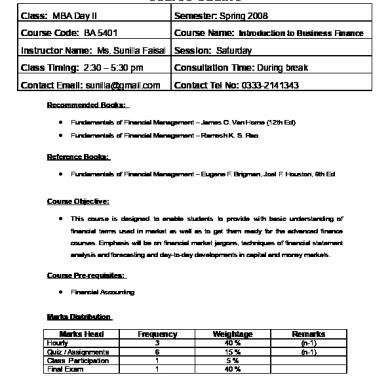

Course Outline Class: MBA Day II

Semester: Spring 2008

Course Code: BA 5401

Course Name: Introduction to Business Finance

Instructor Name: Ms. Sunilla Faisal Session: Saturday Class Timing: 2:30 – 5:30 pm

Consultation Time: During break

Contact Email: [email protected]

Contact Tel No: 0333-2141343

Recommended Books: •

Fundamentals of Financial Management – James C. Van Horne (12th Ed)

•

Fundamentals of Financial Management – Ramesh K. S. Rao

Reference Books: •

Fundamentals of Financial Management – Eugene F. Brigman, Joel F. Houston, 9th Ed

Course Objective: •

This course is designed to enable students to provide with basic understanding of financial terms used in market as well as to get them ready for the advanced finance courses. Emphasis will be on financial market jargons, techniques of financial statement analysis and forecasting and day-to-day developments in capital and money markets.

Course Pre-requisites: •

Financial Accounting

Marks Distribution

Marks Head Hourly Quiz / Assignments Class Participation Final Exam

Frequency

Weightage

Remarks

3 6 1 1

40 % 15 % 5% 40 %

(n-1) (n-1)

Week wise Course Distribution

Weeks

Course Detail

1

An overview/Role of Financial Management

2

Financial Statements and Common size Statements

3

Cash Flow Statements (Direct & Indirect Method)

4

First Hourly + Analysis of Financial Statements

5

Analysis of Financial Statements

6

Financial Forecasting and Budgeting (operating and financial leverage)

7

Time Value of Money

8

Second Hourly + Time Value of Money

9

Determining Cash Flows (Capital Budgeting)

10

Evaluating Cash Flows (Capital Budgeting

11

Working Capital Management

12

Third Hourly + Working Capital Management

13

Receivable Management

14

Cash Management

15

Revision

16

Final Exam

INSTITUTE OF SCIENCE & TECHNOLOGY Plot # 67 Street # 9 Sector H - 8/4 Islamabad Tell # 92 – 051 – 4445480

Course Outline Class: MBA Day II

Semester: Spring 2008

Course Code: BA 5401

Course Name: Introduction to Business Finance

Instructor Name: Ms. Sunilla Faisal Session: Saturday Class Timing: 2:30 – 5:30 pm

Consultation Time: During break

Contact Email: [email protected]

Contact Tel No: 0333-2141343

Recommended Books: •

Fundamentals of Financial Management – James C. Van Horne (12th Ed)

•

Fundamentals of Financial Management – Ramesh K. S. Rao

Reference Books: •

Fundamentals of Financial Management – Eugene F. Brigman, Joel F. Houston, 9th Ed

Course Objective: •

This course is designed to enable students to provide with basic understanding of financial terms used in market as well as to get them ready for the advanced finance courses. Emphasis will be on financial market jargons, techniques of financial statement analysis and forecasting and day-to-day developments in capital and money markets.

Course Pre-requisites: •

Financial Accounting

Marks Distribution

Marks Head Hourly Quiz / Assignments Class Participation Final Exam

Frequency

Weightage

Remarks

3 6 1 1

40 % 15 % 5% 40 %

(n-1) (n-1)

Week wise Course Distribution

Weeks

Course Detail

1

An overview/Role of Financial Management

2

Financial Statements and Common size Statements

3

Cash Flow Statements (Direct & Indirect Method)

4

First Hourly + Analysis of Financial Statements

5

Analysis of Financial Statements

6

Financial Forecasting and Budgeting (operating and financial leverage)

7

Time Value of Money

8

Second Hourly + Time Value of Money

9

Determining Cash Flows (Capital Budgeting)

10

Evaluating Cash Flows (Capital Budgeting

11

Working Capital Management

12

Third Hourly + Working Capital Management

13

Receivable Management

14

Cash Management

15

Revision

16

Final Exam

Related Documents

Ibf Course Outline Apr08

October 2019 10

Course Outline

April 2020 46

Course Outline

October 2019 75

Course Outline

November 2019 69

Course Outline

November 2019 71