Hrm-pay

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Hrm-pay as PDF for free.

More details

- Words: 1,998

- Pages: 34

Human Resource Management

Wage, Salary and Reward Administration

1

Chapter Content: We will cover the following: – – – – –

Remuneration & its Components Compensation Administration Process Wage & salary Administration Different types of reward Different types of Incentives and Incentives Plan – International Compensation.

2

Remuneration & Its Components Definition: Remuneration' is a general term covering the monetary and related entitlements of employees - paid by employers in return for the work of employees. Components:

Remuneration Financial

Hourly and monthly Rated Wages and Salaries

Fringe Benefits Incentives Individual Plans Group Plans

Direct

P.F, Gratuity, Medical Care, Accident Relief, Health and Group insurance

Non Financial Perquisites Company Car, Club Membership, Paid Holidays, Furnished House, Stock option scheme, etc Indirect

Job Content Challenging job, Responsibilities, Recognition, Growth prospects, Supervision, Working conditions, Job sharing, etc. 3

Compensation Administration Process

4

Job Analysis ♦It contains two parts: Job Description & Job

Specification. This can help to know about the duties and responsibilities will be covered by the specific job and also the quality of the people engaged in that job. This is necessary to set a rationale pay structure for a specific position.

5

Job Evaluation Job Evaluation: The systematic determination of the relative worth of jobs within an organization.

Methods of Job Evaluation Ranking

Classification

Job Evaluation Methods Factor Comparison

Point Method 6

Quantitative Job Evaluation Methods ♦ Factor Comparison Job Evaluation Method – Step 1. Obtain job information – Step 2. Select key benchmark jobs – Step 3. Rank key jobs by factor – Step 4. Distribute wage rates by factors – Step 5. Rank key jobs according to wages assigned to each factor – Step 6. Compare the two sets of rankings to screen out unusable key jobs – Step 7. Construct the job-comparison scale – Step 8. Use the job-comparison scale 7

The Point Method of Job Evaluation ♦ Step 1. Determine clusters of jobs to be

evaluated ♦ Step 2. Collect job information ♦ Step 3. Select compensable factors ♦ Step 4. Define compensable factors ♦ Step 5. Define factor degrees ♦ Step 6. Determine relative values of factors 8

Job Evaluation Methods: Ranking ♦ Ranking each job relative to all other jobs,

usually based on some overall factor. ♦ Steps in job ranking: – Obtain job information. – Select and group jobs. – Select compensable factors. – Rank jobs. – Combine ratings. 9

Job Evaluation Methods: Job Classification ♦ Raters categorize jobs into groups or classes

of jobs that are of roughly the same value for pay purposes. – Classes contain similar jobs. – Grades are jobs that are similar in difficulty but otherwise different. – Jobs are classed by the amount or level of compensable factors they contain.

10

Developing Pay Surveys Select Employers with Comparable Jobs

Determine Jobs to be Surveyed

Decide What Information Is Needed

Conduct Survey

11

Pay Structures

♦ Common Pay Structures

– Hourly and salaried – Office, plant, technical, professional, managerial – Clerical, information technology, professional, supervisory, management, and executive ♦ Factors that affect Remuneration/Pay Structure: – External: • Labor market • Cost of Living • Society • The economy • Geographic Location – Internal Factor: • Business Strategy • Job Evaluation & Performance Appraisal • The employee • Kind of business

12

Establishing Pay Structures

13

Wage & Salary ♦ Wages: Wages are compensation. This includes

basic wages, allowances, bonuses etc. On the employers’ points of view, wages form that part of cost of production which is attributed as compensation paid to labor. Wages are paid in the form of time rate or piece rate to the workers, who are directly involved in the production or commercial activities.

♦ Salary: This is compensation paid to the indirect

labor in the form of cash. Indirect labor involves supervisors, managers and supporting staff like office assistants, clerks, etc. Salaries are paid in the form of time rate, mostly on monthly basis.

14

Wage & Salary ♦ On the basis of the employee needs and ability of the

organization, there are various kinds of wages. Wages are generally four types: – Subsistence wages – Minimum Wages – Fair Wages – Living Wages ♦ Subsistence wages: This is level of wage bellows the minimum level which can lead inhuman life to the employees. ♦ Minimum Wages: This is a wage level fixed by government which is considered adequate, taking into account the cost of living. All the organizations are bound to follow this direction so that no employee is paid a wage less than the minimum wage fixed by government irrespective of grade, class or nature of work. 15

Wage & Salary ♦ Fair Wages: This is fixed by employer. This level

of wage varies from industry to industry. The main criteria are the capacity of payment. Fair wage is a wage above the minimum wage but below the living wage.

♦ Living Wages: Living wage is one which should

enable the earner to provide for himself and his family not only the bare essentials of food, clothing and shelter, but a measure of frugal comfort, including education for his children, protection against ill health, requirement of essential social needs and a measure of insurance against the more important misfortune including old age. 16

Reward ♦ People do what they do to satisfy some

need and they look for a payoff or reward. ♦ The most obvious reward is pay, but there are many others, including: – – – –

promotions desirable work assignments peer recognition work freedom

17

Types of Reward

18

Types of Reward Intrinsic versus Extrinsic Rewards ♦ Intrinsic rewards (personal satisfactions) come from the job itself, such as: – pride in one’s work – feelings of accomplishment – being part of a work team

♦ Extrinsic rewards come from a source outside the

job – – – –

include rewards offered mainly by management Money Promotions Benefits 19

Types of Reward Financial versus Non-financial Rewards ♦ Financial rewards include: – – – – – –

wages bonuses profit sharing pension plans paid leaves purchase discounts

♦ Non-financial rewards emphasize making life on

the job more attractive; employees vary greatly on what types they find desirable. 20

Types of Reward Performance-based versus Membership-Based Rewards ♦ Performance-based rewards are tied to specific job performance criteria. – – – – –

commissions piecework pay plans incentive systems group bonuses merit pay

♦ Membership-based rewards such as cost-of-living

increases, benefits, and salary increases are offered to all employees.

21

Incentive Compensation Incentives can be added to the basic pay structure to provide rewards for performance. It may be 3 types: 1. 2. 3.

Individual Incentives Group Incentives Plant-wide Incentives

♦ Individual Incentives include – merit pay plans (annual increase, based on performance) – piecework plans (pay based on number of units produced typically in a specified time period.) – time-savings bonuses and commissions – Work best where clear objectives can be set and tasks are independent.

22

Incentive Compensation Incentive Compensation Plans: ♦ Group Incentives – Incentives can be offered to groups, rather than individuals, when employees' tasks are interdependent and require cooperation.

♦ Plant-wide Incentives: Direct employee efforts

toward organizational goals (such as cost reduction)

– Scanlon Plan - supervisor and employee committees suggest labor-saving improvements – IMPROSHARE - formula is used to determine bonuses based on labor cost savings 23

Different types of Incentive Plan ♦ Incentive Plan /Incentives Payments ♦ There are following three types of incentive plans: – The Rowan plan – Taylor’s Differential Piece Rate Plan – Emerson’s Efficiency Plan – Halsey System – Bedeaux system – Taylor’s Differential Piece Rate System – Merrick Differential Piece Rate System – Gantt Task Method 24

Rowan Plan ♦ In Rowan Plan, bonus paid to the employee is

equal to the proportion of time saved to the standard time. Under the Rowan plan, standard time and rate per hour are fixed. If the time taken to complete the job in equal to or exceeds the standard time, the employee is paid for the time taken at the rate per hour. If the time taken is less than the standard time, the employee is entitled to bonus, in addition to the time wages. The bonus takes the form of a percentage of worker’s timerate. This percentage is equal to the proportion of the saved time, to the standard time. 25

Example of Rowan Plan ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦

Standard time = 10 hrs Rate per hour = Tk.1 Case-1 Time Taken= 10 hrs Earnings = 10X1= Tk. 10.00 Case-2 Time Taken= 12 hrs Earnings = 12X1= Tk. 12.00 Case-1 Time Taken= 8 hrs Earnings = 8X1= Tk. 8.00 Bonus =2/10x8=Tk. 1.60 Tk. 9.60

26

Halsey Plan ♦ In this method bonus paid to a worker is equal to 50% of

♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦

time saved multiplied by rate per hour. a standard time is fixed on the basis of previous performance for the completion of a job. When the work is completed in less than the standard time, for the time actually spent on the job, he is paid at an hourly rate on a percentage (50%) of the time saved by him. Standard Time = 10 Hrs; Rate per hour = Tk. 1 Case-1: Time taken = 10 hrs Earnings = 10*1= Tk 10 Case-2: Time taken = 12 hrs Earnings = 12*1=Tk 12 Case-3: Time taken = 8 hrs Earnings: Time wages = 8*1 = Tk 8.00 Bonus = ½*2*1 = Tk 1.00 Tk 9.00 27

Taylor’s differentiate piece rate system ♦ An efficient (output exceeds standard) worker is

paid 120% of the piece rate and an inefficient (output bellow standard) worker is paid only 80% of the piece rate. ♦ Example: Standard output: 100 units, Standard Rate: Tk 1. ♦ Earnings at 120 units output=120*120/100*1=144 ♦ Earnings at 90 units output = 90*80/100*1=72

28

Emersion’s Plan ♦ In this method upto 67% of efficiency, only time rate is

♦ ♦

♦ ♦

paid to the worker. Beyond this, a graduated bonus of 20% at 100% efficiency is paid. Thereafter, an additional bonus of 1%, for each additional bonus of 1% for each additional 1% efficiency is added Example: Standard output is 100 units in 10 hrs and rate per hour = Tk 1 Earnings at 50 units in 10 hrs= 10*1=Tk 10 [as the efficiency is <67%, the employee will be entitled to time wage only.] Earning at 100 units in 10 hr=10*1+(10*20%)=Tk 12 [use 20% bonus] Earning at 130 units in 10 hr = 10*1 + (10*20%) + (10*30%) =Tk 15 [use 20% for 100% efficiency & additional 1% for 1% more than 100% efficiency] 29

Executive Compensation Components

30

Executive Compensation Programs Salaries of Top Managers – Executive salaries, bonuses and stock options may seem high. – Top twenty CEOs average more than $100 million in total compensation. – Competition for executive talent raises the price of hiring an executive. – High salaries can be a motivator for executives and lower-level managers 31

Executive Compensation Programs Supplemental Financial Compensation – Deferred bonuses – paid to executives over extended time periods, to encourage them to stay with the company. – Stock options – allow executives to purchase stock in the future at a fixed price. – Hiring bonuses – compensate for the deferred compensation lost when leaving a former company. 32

Executive Compensation Programs Supplemental Non-financial Compensation: Perquisites

♦ Perks may include the following:

– Golden parachutes protect executives when a merger or hostile takeover occurs by providing severance pay or a guaranteed position

33

International Compensation ♦ International compensation packages

generally consider the following four factors: – Base Pay: The pay of employees in comparable jobs at home. – Differentials: Compensation given to offset higher costs of living abroad. – Incentives: Inducements given to encourage employees to accept overseas assignments. – Assistance Programs: Payment for expenses involved in moving a family abroad and in providing some services overseas. 34

Wage, Salary and Reward Administration

1

Chapter Content: We will cover the following: – – – – –

Remuneration & its Components Compensation Administration Process Wage & salary Administration Different types of reward Different types of Incentives and Incentives Plan – International Compensation.

2

Remuneration & Its Components Definition: Remuneration' is a general term covering the monetary and related entitlements of employees - paid by employers in return for the work of employees. Components:

Remuneration Financial

Hourly and monthly Rated Wages and Salaries

Fringe Benefits Incentives Individual Plans Group Plans

Direct

P.F, Gratuity, Medical Care, Accident Relief, Health and Group insurance

Non Financial Perquisites Company Car, Club Membership, Paid Holidays, Furnished House, Stock option scheme, etc Indirect

Job Content Challenging job, Responsibilities, Recognition, Growth prospects, Supervision, Working conditions, Job sharing, etc. 3

Compensation Administration Process

4

Job Analysis ♦It contains two parts: Job Description & Job

Specification. This can help to know about the duties and responsibilities will be covered by the specific job and also the quality of the people engaged in that job. This is necessary to set a rationale pay structure for a specific position.

5

Job Evaluation Job Evaluation: The systematic determination of the relative worth of jobs within an organization.

Methods of Job Evaluation Ranking

Classification

Job Evaluation Methods Factor Comparison

Point Method 6

Quantitative Job Evaluation Methods ♦ Factor Comparison Job Evaluation Method – Step 1. Obtain job information – Step 2. Select key benchmark jobs – Step 3. Rank key jobs by factor – Step 4. Distribute wage rates by factors – Step 5. Rank key jobs according to wages assigned to each factor – Step 6. Compare the two sets of rankings to screen out unusable key jobs – Step 7. Construct the job-comparison scale – Step 8. Use the job-comparison scale 7

The Point Method of Job Evaluation ♦ Step 1. Determine clusters of jobs to be

evaluated ♦ Step 2. Collect job information ♦ Step 3. Select compensable factors ♦ Step 4. Define compensable factors ♦ Step 5. Define factor degrees ♦ Step 6. Determine relative values of factors 8

Job Evaluation Methods: Ranking ♦ Ranking each job relative to all other jobs,

usually based on some overall factor. ♦ Steps in job ranking: – Obtain job information. – Select and group jobs. – Select compensable factors. – Rank jobs. – Combine ratings. 9

Job Evaluation Methods: Job Classification ♦ Raters categorize jobs into groups or classes

of jobs that are of roughly the same value for pay purposes. – Classes contain similar jobs. – Grades are jobs that are similar in difficulty but otherwise different. – Jobs are classed by the amount or level of compensable factors they contain.

10

Developing Pay Surveys Select Employers with Comparable Jobs

Determine Jobs to be Surveyed

Decide What Information Is Needed

Conduct Survey

11

Pay Structures

♦ Common Pay Structures

– Hourly and salaried – Office, plant, technical, professional, managerial – Clerical, information technology, professional, supervisory, management, and executive ♦ Factors that affect Remuneration/Pay Structure: – External: • Labor market • Cost of Living • Society • The economy • Geographic Location – Internal Factor: • Business Strategy • Job Evaluation & Performance Appraisal • The employee • Kind of business

12

Establishing Pay Structures

13

Wage & Salary ♦ Wages: Wages are compensation. This includes

basic wages, allowances, bonuses etc. On the employers’ points of view, wages form that part of cost of production which is attributed as compensation paid to labor. Wages are paid in the form of time rate or piece rate to the workers, who are directly involved in the production or commercial activities.

♦ Salary: This is compensation paid to the indirect

labor in the form of cash. Indirect labor involves supervisors, managers and supporting staff like office assistants, clerks, etc. Salaries are paid in the form of time rate, mostly on monthly basis.

14

Wage & Salary ♦ On the basis of the employee needs and ability of the

organization, there are various kinds of wages. Wages are generally four types: – Subsistence wages – Minimum Wages – Fair Wages – Living Wages ♦ Subsistence wages: This is level of wage bellows the minimum level which can lead inhuman life to the employees. ♦ Minimum Wages: This is a wage level fixed by government which is considered adequate, taking into account the cost of living. All the organizations are bound to follow this direction so that no employee is paid a wage less than the minimum wage fixed by government irrespective of grade, class or nature of work. 15

Wage & Salary ♦ Fair Wages: This is fixed by employer. This level

of wage varies from industry to industry. The main criteria are the capacity of payment. Fair wage is a wage above the minimum wage but below the living wage.

♦ Living Wages: Living wage is one which should

enable the earner to provide for himself and his family not only the bare essentials of food, clothing and shelter, but a measure of frugal comfort, including education for his children, protection against ill health, requirement of essential social needs and a measure of insurance against the more important misfortune including old age. 16

Reward ♦ People do what they do to satisfy some

need and they look for a payoff or reward. ♦ The most obvious reward is pay, but there are many others, including: – – – –

promotions desirable work assignments peer recognition work freedom

17

Types of Reward

18

Types of Reward Intrinsic versus Extrinsic Rewards ♦ Intrinsic rewards (personal satisfactions) come from the job itself, such as: – pride in one’s work – feelings of accomplishment – being part of a work team

♦ Extrinsic rewards come from a source outside the

job – – – –

include rewards offered mainly by management Money Promotions Benefits 19

Types of Reward Financial versus Non-financial Rewards ♦ Financial rewards include: – – – – – –

wages bonuses profit sharing pension plans paid leaves purchase discounts

♦ Non-financial rewards emphasize making life on

the job more attractive; employees vary greatly on what types they find desirable. 20

Types of Reward Performance-based versus Membership-Based Rewards ♦ Performance-based rewards are tied to specific job performance criteria. – – – – –

commissions piecework pay plans incentive systems group bonuses merit pay

♦ Membership-based rewards such as cost-of-living

increases, benefits, and salary increases are offered to all employees.

21

Incentive Compensation Incentives can be added to the basic pay structure to provide rewards for performance. It may be 3 types: 1. 2. 3.

Individual Incentives Group Incentives Plant-wide Incentives

♦ Individual Incentives include – merit pay plans (annual increase, based on performance) – piecework plans (pay based on number of units produced typically in a specified time period.) – time-savings bonuses and commissions – Work best where clear objectives can be set and tasks are independent.

22

Incentive Compensation Incentive Compensation Plans: ♦ Group Incentives – Incentives can be offered to groups, rather than individuals, when employees' tasks are interdependent and require cooperation.

♦ Plant-wide Incentives: Direct employee efforts

toward organizational goals (such as cost reduction)

– Scanlon Plan - supervisor and employee committees suggest labor-saving improvements – IMPROSHARE - formula is used to determine bonuses based on labor cost savings 23

Different types of Incentive Plan ♦ Incentive Plan /Incentives Payments ♦ There are following three types of incentive plans: – The Rowan plan – Taylor’s Differential Piece Rate Plan – Emerson’s Efficiency Plan – Halsey System – Bedeaux system – Taylor’s Differential Piece Rate System – Merrick Differential Piece Rate System – Gantt Task Method 24

Rowan Plan ♦ In Rowan Plan, bonus paid to the employee is

equal to the proportion of time saved to the standard time. Under the Rowan plan, standard time and rate per hour are fixed. If the time taken to complete the job in equal to or exceeds the standard time, the employee is paid for the time taken at the rate per hour. If the time taken is less than the standard time, the employee is entitled to bonus, in addition to the time wages. The bonus takes the form of a percentage of worker’s timerate. This percentage is equal to the proportion of the saved time, to the standard time. 25

Example of Rowan Plan ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦

Standard time = 10 hrs Rate per hour = Tk.1 Case-1 Time Taken= 10 hrs Earnings = 10X1= Tk. 10.00 Case-2 Time Taken= 12 hrs Earnings = 12X1= Tk. 12.00 Case-1 Time Taken= 8 hrs Earnings = 8X1= Tk. 8.00 Bonus =2/10x8=Tk. 1.60 Tk. 9.60

26

Halsey Plan ♦ In this method bonus paid to a worker is equal to 50% of

♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦

time saved multiplied by rate per hour. a standard time is fixed on the basis of previous performance for the completion of a job. When the work is completed in less than the standard time, for the time actually spent on the job, he is paid at an hourly rate on a percentage (50%) of the time saved by him. Standard Time = 10 Hrs; Rate per hour = Tk. 1 Case-1: Time taken = 10 hrs Earnings = 10*1= Tk 10 Case-2: Time taken = 12 hrs Earnings = 12*1=Tk 12 Case-3: Time taken = 8 hrs Earnings: Time wages = 8*1 = Tk 8.00 Bonus = ½*2*1 = Tk 1.00 Tk 9.00 27

Taylor’s differentiate piece rate system ♦ An efficient (output exceeds standard) worker is

paid 120% of the piece rate and an inefficient (output bellow standard) worker is paid only 80% of the piece rate. ♦ Example: Standard output: 100 units, Standard Rate: Tk 1. ♦ Earnings at 120 units output=120*120/100*1=144 ♦ Earnings at 90 units output = 90*80/100*1=72

28

Emersion’s Plan ♦ In this method upto 67% of efficiency, only time rate is

♦ ♦

♦ ♦

paid to the worker. Beyond this, a graduated bonus of 20% at 100% efficiency is paid. Thereafter, an additional bonus of 1%, for each additional bonus of 1% for each additional 1% efficiency is added Example: Standard output is 100 units in 10 hrs and rate per hour = Tk 1 Earnings at 50 units in 10 hrs= 10*1=Tk 10 [as the efficiency is <67%, the employee will be entitled to time wage only.] Earning at 100 units in 10 hr=10*1+(10*20%)=Tk 12 [use 20% bonus] Earning at 130 units in 10 hr = 10*1 + (10*20%) + (10*30%) =Tk 15 [use 20% for 100% efficiency & additional 1% for 1% more than 100% efficiency] 29

Executive Compensation Components

30

Executive Compensation Programs Salaries of Top Managers – Executive salaries, bonuses and stock options may seem high. – Top twenty CEOs average more than $100 million in total compensation. – Competition for executive talent raises the price of hiring an executive. – High salaries can be a motivator for executives and lower-level managers 31

Executive Compensation Programs Supplemental Financial Compensation – Deferred bonuses – paid to executives over extended time periods, to encourage them to stay with the company. – Stock options – allow executives to purchase stock in the future at a fixed price. – Hiring bonuses – compensate for the deferred compensation lost when leaving a former company. 32

Executive Compensation Programs Supplemental Non-financial Compensation: Perquisites

♦ Perks may include the following:

– Golden parachutes protect executives when a merger or hostile takeover occurs by providing severance pay or a guaranteed position

33

International Compensation ♦ International compensation packages

generally consider the following four factors: – Base Pay: The pay of employees in comparable jobs at home. – Differentials: Compensation given to offset higher costs of living abroad. – Incentives: Inducements given to encourage employees to accept overseas assignments. – Assistance Programs: Payment for expenses involved in moving a family abroad and in providing some services overseas. 34

More Documents from "MOHAMMED ALI CHOWDHURY"

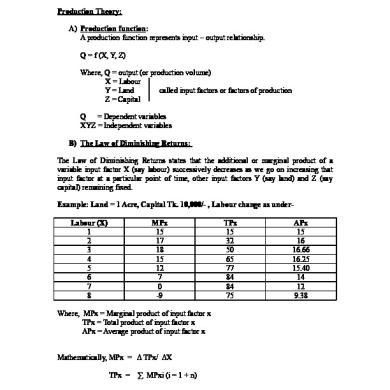

Production Theory

May 2020 21

Islami Song

June 2020 20

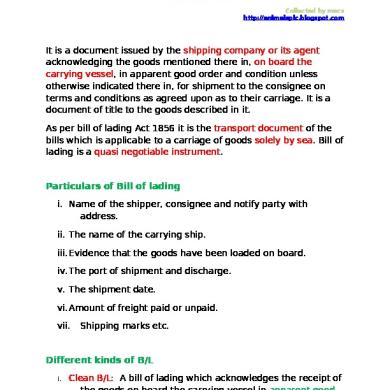

Bill Of Lading

July 2020 19

Incentives For Exporters

July 2020 27

Managing Marteing Channels

May 2020 0