Different Parties Of A Documentary Credit

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Different Parties Of A Documentary Credit as PDF for free.

More details

- Words: 621

- Pages: 2

Different Parties of a Documentary Credit Normally the following parties are involved to a documentary credit. 1. The Issuing Bank or opening bank This issuing bank of opening bank is the bank of importer’s who issues a Letter of Credit being requested by the importer on the basis of the terms and conditions of concerned sales contract. 2. Nominated bank or Intermediary Bank Nominated bank or Intermediary bank may be: i)

The Advising Bank/Notifying Bank The advising /notifying bank is the bank through which the L/C is advised to the exporter without engagement on the part of the advising bank. However, the advising bank shall take reasonable care to check the apparent authenticity of the L/C, which it advises. It is located in the same area of the exporter and it may be a branch or a corresponding of the opening bank/issuing bank.

ii)

The confirming Bank Sometimes the beneficiary of the L/C desires that the L/C must be confirmed by a bank in his own country. This is a third Bank who gives assurance for payment to the beneficiary in addition to the issuing bank.

iii)

Negotiating Bank In letter of credit, a negotiating bank is a bank that takes up the documents from the beneficiary, examines the same and if the terms of the L/C are complied with then gives value to the beneficiary for those documents. In simpler terms, the negotiating bank purchase letter of credit documents from the L/C beneficiary, paying the beneficiary either at a discount from the face value of the documents or against the payment of fees. This bank is authorized to claim and get reimbursement of the amount paid by them on negotiation of documents from the issuing bank. Usually this is exporter’s Bank who purchases the export documents.

iv)

Accepting Bank Accepting bank is the bank nominated in the letter of credit to accept usance bills drawn under the credit. If the bank, so nominated, accepts the nomination, its responsibility to the beneficiary is not only to accept the drafts drawn, but also to make payment on their due dates.

v)

Paying Bank This bank is a bank, which is nominated in the letter of credit to make payment against documents to be tendered under the credit. Paying bank must examine all documents with reasonable care to ascertain that these are drawn in accordance with the terms and conditions of the credit. It is banks situated in the beneficiary’s country i.e. exporter’s country.

vi)

Reimbursing Bank The reimbursing bank is a bank with whom the issuing bank maintains an account. This bank acts as Agent of the issuing bank and is authorized to make payment or to honour reimbursing claim of the Negotiating Bank.

vii)

The Transferring Bank In case of transferable L/C, the first beneficiary may transfer the L/C to the second beneficiary through a Bank nominated by the Issuing Bank. This nominated Bank is called the Transferring bank.

3. The Applicant or Buyer (Importer) Importer or buyer is the applicant of a Letter of Credit. Applicant must be the client of the Issuing Bank. Under the application cum agreement for opening the credit, the applicant agrees that till reimburses the issuing bank, the goods that are covered they the documents shall stand charged to the bank. The applicant is liable to indemnify the banks against all obligations. And responsibilities imposed by foreign law and usages. 4. The Beneficiary or Seller (Exporter) Exporter or seller of the goods in the Beneficiary of a letter of credit. The letter of credit is opened in his favour and is addressed to him. The beneficiary has the obligation to make export as per the contract and produce the documents as required by the credit.

The Advising Bank/Notifying Bank The advising /notifying bank is the bank through which the L/C is advised to the exporter without engagement on the part of the advising bank. However, the advising bank shall take reasonable care to check the apparent authenticity of the L/C, which it advises. It is located in the same area of the exporter and it may be a branch or a corresponding of the opening bank/issuing bank.

ii)

The confirming Bank Sometimes the beneficiary of the L/C desires that the L/C must be confirmed by a bank in his own country. This is a third Bank who gives assurance for payment to the beneficiary in addition to the issuing bank.

iii)

Negotiating Bank In letter of credit, a negotiating bank is a bank that takes up the documents from the beneficiary, examines the same and if the terms of the L/C are complied with then gives value to the beneficiary for those documents. In simpler terms, the negotiating bank purchase letter of credit documents from the L/C beneficiary, paying the beneficiary either at a discount from the face value of the documents or against the payment of fees. This bank is authorized to claim and get reimbursement of the amount paid by them on negotiation of documents from the issuing bank. Usually this is exporter’s Bank who purchases the export documents.

iv)

Accepting Bank Accepting bank is the bank nominated in the letter of credit to accept usance bills drawn under the credit. If the bank, so nominated, accepts the nomination, its responsibility to the beneficiary is not only to accept the drafts drawn, but also to make payment on their due dates.

v)

Paying Bank This bank is a bank, which is nominated in the letter of credit to make payment against documents to be tendered under the credit. Paying bank must examine all documents with reasonable care to ascertain that these are drawn in accordance with the terms and conditions of the credit. It is banks situated in the beneficiary’s country i.e. exporter’s country.

vi)

Reimbursing Bank The reimbursing bank is a bank with whom the issuing bank maintains an account. This bank acts as Agent of the issuing bank and is authorized to make payment or to honour reimbursing claim of the Negotiating Bank.

vii)

The Transferring Bank In case of transferable L/C, the first beneficiary may transfer the L/C to the second beneficiary through a Bank nominated by the Issuing Bank. This nominated Bank is called the Transferring bank.

3. The Applicant or Buyer (Importer) Importer or buyer is the applicant of a Letter of Credit. Applicant must be the client of the Issuing Bank. Under the application cum agreement for opening the credit, the applicant agrees that till reimburses the issuing bank, the goods that are covered they the documents shall stand charged to the bank. The applicant is liable to indemnify the banks against all obligations. And responsibilities imposed by foreign law and usages. 4. The Beneficiary or Seller (Exporter) Exporter or seller of the goods in the Beneficiary of a letter of credit. The letter of credit is opened in his favour and is addressed to him. The beneficiary has the obligation to make export as per the contract and produce the documents as required by the credit.

Related Documents

Different Parties Of A Documentary Credit

May 2020 19

Documentary Letter Of Credit

April 2020 56

Documentary Letters Of Credit

November 2019 49

Parties

April 2020 24

What Is A Documentary

July 2020 18

Heathens Of A Different Stripe

December 2019 2More Documents from ""

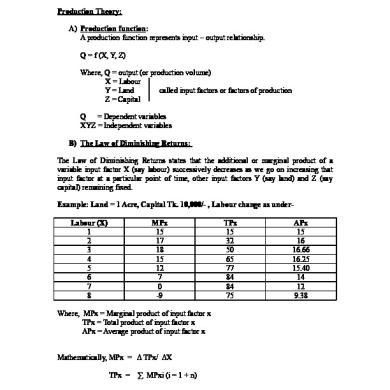

Production Theory

May 2020 21

Islami Song

June 2020 20

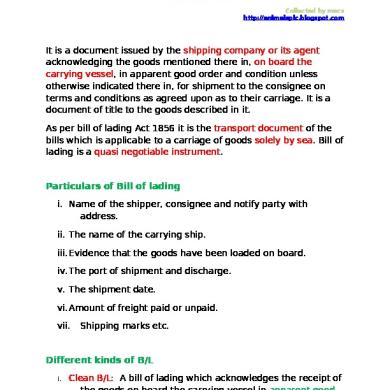

Bill Of Lading

July 2020 19

Incentives For Exporters

July 2020 27

Managing Marteing Channels

May 2020 0