Pricing & Costing:: Including Budgeting & Life Cycle Costing

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Pricing & Costing:: Including Budgeting & Life Cycle Costing as PDF for free.

More details

- Words: 1,495

- Pages: 45

Pricing & Costing: including budgeting & life cycle costing Anjana Vivek [email protected] www.bizkul.com

1

Costs: Some terms

Direct Indirect Committed Flexible

www.bizkul.com

2

Costs

Fixed Variable Semi variable

www.bizkul.com

3

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

What is the profit margin ?? www.bizkul.com

4

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

What are your thoughts on the profit so calculated? www.bizkul.com

5

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

Do you think this is the true profit? How has indirect cost been calculated (allocated)? What are your views on the costing? www.bizkul.com

6

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

How does change in basis of allocation impact profit ? www.bizkul.com

7

Solution Case I Amt Rs. Restaurant Revenues

A

B

Total

1,000,000

400,000

1,400,000

Direct

600,000

220,000

820,000

Indirect

200,000

100,000

300,000

Margin

200,000

80,000

280,000

20

20

20

% margin

www.bizkul.com

8

Alternate scenario Case II Amt Rs. Restaurant Revenues

A

B

Total

1,000,000

400,000

1,400,000

Direct

600,000

220,000

820,000

Indirect

150,000

150,000

300,000

Margin

250,000

30,000

280,000

25

7.5

20

% margin

www.bizkul.com

9

Costs

Costs are incurred in a variety of functions in business – Establishing business – R&D – Production / Delivery of service – Sales and marketing – After sales service – Administration www.bizkul.com

10

Importance of costing

Planning Controlling Decision making Implementing Continuous improvement www.bizkul.com

11

Costs

Controllable Joint Discretionary Relevant Sunk Opportunity www.bizkul.com

12

Costs: Analysis

Useful to decide what is controllable and what is not Helps to understand what is relevant to decision making Must be done with care to avoid incorrect decisions

www.bizkul.com

13

Relevant costs

Expected future costs to help in making decisions Differ with alternate courses of action – Managers make decisions based on costs allocated – Managers may make short run decisions that may affect long term business and sales

Relevant costs help choose between alternatives www.bizkul.com

14

Costs - relevant / not relevant

Equipment replacement – Book value of old equipment – not relevant – Current disposal price of old equipment – relevant – Cost of equipment - relevant

www.bizkul.com

15

Costing: Some terms

Contribution margin Break even point

www.bizkul.com

16

Break even point

Ram Kumar wants to sell Computer tables and chairs at a conference stall He estimates that he can sell each unit for Rs. 10,000 each The cost per unit is Rs. 6,000 The stall rent is Rs. One lakh How many units must Ram Kumar sell to break even? www.bizkul.com

17

Break even point

In continuation of the previous example, assume that Rs.6000 is not cost, ie assume some raw material which is anyway spare – eg. wood, is used for this purpose. So this cost actually may not be relevant, thou labour cost may be relevant then what happens to your decision? Try to develop a different perspective and way of thinking www.bizkul.com

18

Costing: Some terms Contribution margin = Sales – total variable cost

www.bizkul.com

19

Costs: Analysis

Identify cost objects / cost centres Accumulate costs Assign / trace costs to cost objects

www.bizkul.com

20

Assignment / Allocation Selection of Activity base – people; machine hours; material consumed Activity level – normal/abnormal

www.bizkul.com

21

Budgets

Plan performance in advance for a given time frame Review performance with budget Understand reasons for variation Take remedial measures if required Plan again based on actual performance and feedback www.bizkul.com

22

Budgets

Keep company objectives in mind Long term and short term Rolling budgets

www.bizkul.com

23

Budgets

Master budget, comprising of detailed budgets for eg. budgets for – Income – Production – Direct costs – R&D – Administration www.bizkul.com

24

Product budget

Expected sale Inventory on hand Production schedule Direct costs Indirect costs Company policies and strategy www.bizkul.com

25

Life cycle costing

Considers entire life cycle of product from start to finish Provides important information for pricing decisions For example, if a mobile phone is built, if the R&D costs are high for the company, the repairs and maintenance cost to the customer may be low; so the life cycle is across the life of the product and considers costs www.bizkul.com and impact on prices 26

Life cycle costs

Upstream costs – R&D, design, prototyping, testing, quality development

Manufacturing/Operations costs – Purchasing, manufacture/service

Downstream costs – marketing, sales and distribution, customer service and warranty www.bizkul.com

27

Life cycle costs

Product life cycle costs vary with industry and nature of industry R&D is not only at start of product life, this may also occur at other stages, ie development of additional features in product Life cycle may also depend on markets targeted, ie country, region, socio-economic background etc. www.bizkul.com 28

Implementation of LCC

Identify stages in product life cycle Identify target customer Understand target customers perspective and estimate need Analyse cost and pricing in detail Educate employees about LCC www.bizkul.com

29

Implementation of LCC

Develop product and pricing structure based on LCC Create appropriate organisation structure for implementation Educate customer on LCC, eg. mobile phone referred to in earlier slide Focus on strategic marketing to address customer requirements and needs, stated and unstated Continuous life cycle budgeting and monitoring and modify/change as required www.bizkul.com 30

Life cycle costing benefits

Optimisation of profit over product life Full set of costs associated with products are ascertained – Most accounting systems capture manufacturing costs – Other areas like R&D at start and customer service as close do not get much importance www.bizkul.com

31

Life cycle costing benefits

Differences in percentages in committed costs at initial stage of business is highlighted – The higher the initial costs, the more critical it is for management to develop better predictions about revenues

www.bizkul.com

32

Life cycle costing benefits

Interrelationships across cost categories are highlighted – Many companies with high R&D & product refinement costs may experience less customer service costs and vice versa. Such costs are often hidden and affect quality of product

www.bizkul.com

33

Pricing

Intuitive Rule of thumb Trial and error Discount Premium Mark up www.bizkul.com

34

Pricing decisions Influenced by Costs Competitors Customers Time horizon – short run or long run decisions Strategic reasons www.bizkul.com

35

Target Pricing

Develop product Set target price Try to achieve target cost Target cost = Competitive price – desired profit www.bizkul.com

36

Pricing for short run

Decide on relevant costs that should be used Compute costs, direct, indirect and total Compute any special costs that need to be incurred and savings that may be possible Decide on pricing based on other factors such as long term impact, competition etc. www.bizkul.com

37

Pricing for long run

Important to consider long term pricing for long term sustainability and growth of business Initial pricing and short term pricing should keep long term pricing in mind Image and brand of business to be considered in pricing Costs to be understood and allocated Consistency in pricing in long term www.bizkul.com

38

…..to trigger thinking

www.bizkul.com

39

A cup of coffee

A cup of coffee costs Rs. 10 to make

HOW will you plan to price this?

……….. continued.. www.bizkul.com

40

A cup of coffee

Will you charge based on the price of coffee in similar coffee shops and restaurants?

……….. continued.. www.bizkul.com

41

A cup of coffee

Will you charge cost plus a margin?

……….. continued..

www.bizkul.com

42

A cup of coffee

OR will you think differently?

……….. continued..

www.bizkul.com

43

A cup of coffee For example …

You could charge differently during the rush hour You could have special rates in non rush hours

www.bizkul.com

44

Some thoughts… You can … if you want

Think differently about your pricing Think differently about your negotiations for pricing and selling www.bizkul.com

45

1

Costs: Some terms

Direct Indirect Committed Flexible

www.bizkul.com

2

Costs

Fixed Variable Semi variable

www.bizkul.com

3

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

What is the profit margin ?? www.bizkul.com

4

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

What are your thoughts on the profit so calculated? www.bizkul.com

5

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

Do you think this is the true profit? How has indirect cost been calculated (allocated)? What are your views on the costing? www.bizkul.com

6

Exercise Revenue- Restaurant Restaurant Direct - Restaurant Restaurant Indirect - Restaurant Restaurant

A B A B A B

– – – – – –

Rs. 10,00,000 Rs. 4,00,000 Rs. 6,00,000 Rs. 2,20,000 Rs. 2,00,000 Rs. 80,000

How does change in basis of allocation impact profit ? www.bizkul.com

7

Solution Case I Amt Rs. Restaurant Revenues

A

B

Total

1,000,000

400,000

1,400,000

Direct

600,000

220,000

820,000

Indirect

200,000

100,000

300,000

Margin

200,000

80,000

280,000

20

20

20

% margin

www.bizkul.com

8

Alternate scenario Case II Amt Rs. Restaurant Revenues

A

B

Total

1,000,000

400,000

1,400,000

Direct

600,000

220,000

820,000

Indirect

150,000

150,000

300,000

Margin

250,000

30,000

280,000

25

7.5

20

% margin

www.bizkul.com

9

Costs

Costs are incurred in a variety of functions in business – Establishing business – R&D – Production / Delivery of service – Sales and marketing – After sales service – Administration www.bizkul.com

10

Importance of costing

Planning Controlling Decision making Implementing Continuous improvement www.bizkul.com

11

Costs

Controllable Joint Discretionary Relevant Sunk Opportunity www.bizkul.com

12

Costs: Analysis

Useful to decide what is controllable and what is not Helps to understand what is relevant to decision making Must be done with care to avoid incorrect decisions

www.bizkul.com

13

Relevant costs

Expected future costs to help in making decisions Differ with alternate courses of action – Managers make decisions based on costs allocated – Managers may make short run decisions that may affect long term business and sales

Relevant costs help choose between alternatives www.bizkul.com

14

Costs - relevant / not relevant

Equipment replacement – Book value of old equipment – not relevant – Current disposal price of old equipment – relevant – Cost of equipment - relevant

www.bizkul.com

15

Costing: Some terms

Contribution margin Break even point

www.bizkul.com

16

Break even point

Ram Kumar wants to sell Computer tables and chairs at a conference stall He estimates that he can sell each unit for Rs. 10,000 each The cost per unit is Rs. 6,000 The stall rent is Rs. One lakh How many units must Ram Kumar sell to break even? www.bizkul.com

17

Break even point

In continuation of the previous example, assume that Rs.6000 is not cost, ie assume some raw material which is anyway spare – eg. wood, is used for this purpose. So this cost actually may not be relevant, thou labour cost may be relevant then what happens to your decision? Try to develop a different perspective and way of thinking www.bizkul.com

18

Costing: Some terms Contribution margin = Sales – total variable cost

www.bizkul.com

19

Costs: Analysis

Identify cost objects / cost centres Accumulate costs Assign / trace costs to cost objects

www.bizkul.com

20

Assignment / Allocation Selection of Activity base – people; machine hours; material consumed Activity level – normal/abnormal

www.bizkul.com

21

Budgets

Plan performance in advance for a given time frame Review performance with budget Understand reasons for variation Take remedial measures if required Plan again based on actual performance and feedback www.bizkul.com

22

Budgets

Keep company objectives in mind Long term and short term Rolling budgets

www.bizkul.com

23

Budgets

Master budget, comprising of detailed budgets for eg. budgets for – Income – Production – Direct costs – R&D – Administration www.bizkul.com

24

Product budget

Expected sale Inventory on hand Production schedule Direct costs Indirect costs Company policies and strategy www.bizkul.com

25

Life cycle costing

Considers entire life cycle of product from start to finish Provides important information for pricing decisions For example, if a mobile phone is built, if the R&D costs are high for the company, the repairs and maintenance cost to the customer may be low; so the life cycle is across the life of the product and considers costs www.bizkul.com and impact on prices 26

Life cycle costs

Upstream costs – R&D, design, prototyping, testing, quality development

Manufacturing/Operations costs – Purchasing, manufacture/service

Downstream costs – marketing, sales and distribution, customer service and warranty www.bizkul.com

27

Life cycle costs

Product life cycle costs vary with industry and nature of industry R&D is not only at start of product life, this may also occur at other stages, ie development of additional features in product Life cycle may also depend on markets targeted, ie country, region, socio-economic background etc. www.bizkul.com 28

Implementation of LCC

Identify stages in product life cycle Identify target customer Understand target customers perspective and estimate need Analyse cost and pricing in detail Educate employees about LCC www.bizkul.com

29

Implementation of LCC

Develop product and pricing structure based on LCC Create appropriate organisation structure for implementation Educate customer on LCC, eg. mobile phone referred to in earlier slide Focus on strategic marketing to address customer requirements and needs, stated and unstated Continuous life cycle budgeting and monitoring and modify/change as required www.bizkul.com 30

Life cycle costing benefits

Optimisation of profit over product life Full set of costs associated with products are ascertained – Most accounting systems capture manufacturing costs – Other areas like R&D at start and customer service as close do not get much importance www.bizkul.com

31

Life cycle costing benefits

Differences in percentages in committed costs at initial stage of business is highlighted – The higher the initial costs, the more critical it is for management to develop better predictions about revenues

www.bizkul.com

32

Life cycle costing benefits

Interrelationships across cost categories are highlighted – Many companies with high R&D & product refinement costs may experience less customer service costs and vice versa. Such costs are often hidden and affect quality of product

www.bizkul.com

33

Pricing

Intuitive Rule of thumb Trial and error Discount Premium Mark up www.bizkul.com

34

Pricing decisions Influenced by Costs Competitors Customers Time horizon – short run or long run decisions Strategic reasons www.bizkul.com

35

Target Pricing

Develop product Set target price Try to achieve target cost Target cost = Competitive price – desired profit www.bizkul.com

36

Pricing for short run

Decide on relevant costs that should be used Compute costs, direct, indirect and total Compute any special costs that need to be incurred and savings that may be possible Decide on pricing based on other factors such as long term impact, competition etc. www.bizkul.com

37

Pricing for long run

Important to consider long term pricing for long term sustainability and growth of business Initial pricing and short term pricing should keep long term pricing in mind Image and brand of business to be considered in pricing Costs to be understood and allocated Consistency in pricing in long term www.bizkul.com

38

…..to trigger thinking

www.bizkul.com

39

A cup of coffee

A cup of coffee costs Rs. 10 to make

HOW will you plan to price this?

……….. continued.. www.bizkul.com

40

A cup of coffee

Will you charge based on the price of coffee in similar coffee shops and restaurants?

……….. continued.. www.bizkul.com

41

A cup of coffee

Will you charge cost plus a margin?

……….. continued..

www.bizkul.com

42

A cup of coffee

OR will you think differently?

……….. continued..

www.bizkul.com

43

A cup of coffee For example …

You could charge differently during the rush hour You could have special rates in non rush hours

www.bizkul.com

44

Some thoughts… You can … if you want

Think differently about your pricing Think differently about your negotiations for pricing and selling www.bizkul.com

45

Related Documents

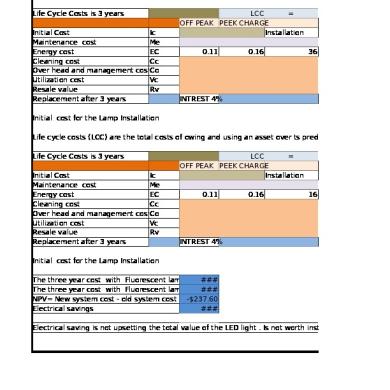

Life Cycle Costing

May 2020 15

Life Cycle Costing

November 2019 24

Life Cycle Costing

December 2019 8

Costing

December 2019 40