Ibf Presentation

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Ibf Presentation as PDF for free.

More details

- Words: 827

- Pages: 7

Ratios

2006

Industry Result

Short Term Solvency Ratios Current Ratio Quick Ratio Cash Ratio Working Capital

0.85

2

Worse

0.374

1.5

Worse

0.021

1.25

Worse

(67,126,687)

5,500,000

Worse

Long Term Solvency Ratios/Stability Ratios Debt Ratio Debt to Equity Ratio Time Interest Earned

0.714

0.7

Average

2.49

0.10

Worse

2.195 times

20 times

Worse

Assets Utilization Ratios Account Receivable Turnover Average Collection Period Inventory Turnover

Good

48.71 times

14 times

7.5 days

25 days

3.54 days

21 days

Worse

Fixed Assets Turnover

0.701 times

10 times

Worse

Total Assets Turnover

0.737 times

6 times

Worse

Good

Profitability Ratios Gross Profit Margin

15.1%

30%

Worse

Operating Profit Margin

9.4%

25%

Worse

Net Profit Margin

0.89%

20%

Worse

Return on Assets

0.6%

18%

Worse

Return on Equity

1.45%

12%

Worse

Earning per Share

0.86

Dividend per Share

1.48

Ratios

2006

2005

2004 Result

Short Term Solvency Ratios Current Ratio Quick Ratio Cash Ratio Working Capital

0.853

1.082

0.777

Average

0.236

0.550

0.341

Average

0.021

0.014

0.004

Worse

(67,126,687)

17,219,191

(65,722,452)

Average

Long Term Solvency Ratios/Stability Ratios Debt Ratio Debt to Equity Ratio Time Interest Earned

0.714

0.502

0.637

Average

2.494

1.011

1.759

Average

2.195 times

1.043 times

1.743 times

Average

Assets Utilization Ratios Account Receivable Turnover Average Collection Period

Good

48.71 times

58.13 times

174.8 times

7.5 days

6.27 days

2.1 days

Good

Inventory Turnover

3.54 days

10.8 days

7.49 days

Average

Fixed Assets Turnover

0.701 times

1.233 times

1.219 times

Average

Total Assets Turnover

0.737 times

1.202 times

1.341 times

Good

Profitability Ratios Gross Profit Margin

15.1%

15.8%

12.1%

Worse

Operating Profit Margin

9.4%

10.8%

7.3%

Worse

Net Profit Margin

0.89%

6.3%

3.5%

Worse

Return on Assets

0.6%

7.6%

4.7%

Worse

Return on Equity

1.4%

15.3%

13.0%

Worse

Recommendations The company has an average position that in 2004 it is in worse condition but in 2005 again it become in stable position but again it gone to worse condition in 2006. The recommendations which can help this company are as follows: ♦ As the short term solvency ratios of this company are in worse condition so the company should payoff his liabilities so that it is in position to maintain its current ratio, quick ratio, cash ratio and its working capital. ♦ The company should payoff his Liabilities to maintain its Debt Ratio and Debt to Equity Ratio and it should maintain its sales so that it can increase its Time Interest Earned. ♦ To maintain the inventory turnover the company should increase its sales so that it can maintain its Inventory Turnover, and it should also increase its net sales by offering discount to its customer to maintain its Fixed and Total Assets Turnover. ♦ The company should increase its net sales to maintain its Gross Profit Margin, Operating Profit Margin and Net Profit Margin, it should increase its sales to get more profit so that it is able to maintain its Return On Assets and Return on Equity.

Cross Sectional Graphical Representation 2004 2005 2006

By seeing overall results of 2004, 2005 and 2006, in cross sectional analysis, company performance is better in 2005 then 2004 and 2006.

Time Series Graphical Representation 50 40 30 20 10 0

2004

2005

2006

By seeing overall results of 2004, 2005 and 2006, in time series analysis, company performance is better in 2005 then 2004 and 2006.

About a company; The company which is being selected for this report is

Kohinoor Sugar Mills Ltd. FAROOQ AHMED is a company secretary. Its registered office is in 29 – G, GULBERG – II, LAHORE and mills are in JAUHARABAD, DISTRICT KHUSHAB. STATEMENT OF ETHICS AND BUSINESS PRACTICE Code of ethics is a pre-requisite for all directors and employees of Kohinoor Sugar Mills Limited. We endeavor to have fully groomed employees committed to carry out honestly activities assigned to them. Our aim is to have high standard of excellence for the products and for all those involved with our Company. VISION STATEMENT To become a market leader in the Industry setting out high quality standards for the Company and others to follow. MISSION STATEMENT To produce/manufacture quality sugar and molasses by maintaining a high standard of efficiency and staying competitive to ensure customer satisfaction and to provide a comfortable level of return to all stakeholders.

Financial statement analysis: It is a set of four related accounting reports which shows the position and results of operations of an entity during a particular period of time. It includes; • • • •

Income statement Balance sheet Statement of cash flows Statement of retained earning

Types of Analysis; 1. Cross sectional analysis 2. Time series analysis

Cross sectional analysis: Financial results of the firm are compared with the result of industry.

Time series analysis: Evaluation of the firm financial performance over time (using financial ratio analysis) is known as Time series analysis. We do this analysis to; • Know the strengths and weakness • Know the historical performance • Know the current financial position of firm

2006

Industry Result

Short Term Solvency Ratios Current Ratio Quick Ratio Cash Ratio Working Capital

0.85

2

Worse

0.374

1.5

Worse

0.021

1.25

Worse

(67,126,687)

5,500,000

Worse

Long Term Solvency Ratios/Stability Ratios Debt Ratio Debt to Equity Ratio Time Interest Earned

0.714

0.7

Average

2.49

0.10

Worse

2.195 times

20 times

Worse

Assets Utilization Ratios Account Receivable Turnover Average Collection Period Inventory Turnover

Good

48.71 times

14 times

7.5 days

25 days

3.54 days

21 days

Worse

Fixed Assets Turnover

0.701 times

10 times

Worse

Total Assets Turnover

0.737 times

6 times

Worse

Good

Profitability Ratios Gross Profit Margin

15.1%

30%

Worse

Operating Profit Margin

9.4%

25%

Worse

Net Profit Margin

0.89%

20%

Worse

Return on Assets

0.6%

18%

Worse

Return on Equity

1.45%

12%

Worse

Earning per Share

0.86

Dividend per Share

1.48

Ratios

2006

2005

2004 Result

Short Term Solvency Ratios Current Ratio Quick Ratio Cash Ratio Working Capital

0.853

1.082

0.777

Average

0.236

0.550

0.341

Average

0.021

0.014

0.004

Worse

(67,126,687)

17,219,191

(65,722,452)

Average

Long Term Solvency Ratios/Stability Ratios Debt Ratio Debt to Equity Ratio Time Interest Earned

0.714

0.502

0.637

Average

2.494

1.011

1.759

Average

2.195 times

1.043 times

1.743 times

Average

Assets Utilization Ratios Account Receivable Turnover Average Collection Period

Good

48.71 times

58.13 times

174.8 times

7.5 days

6.27 days

2.1 days

Good

Inventory Turnover

3.54 days

10.8 days

7.49 days

Average

Fixed Assets Turnover

0.701 times

1.233 times

1.219 times

Average

Total Assets Turnover

0.737 times

1.202 times

1.341 times

Good

Profitability Ratios Gross Profit Margin

15.1%

15.8%

12.1%

Worse

Operating Profit Margin

9.4%

10.8%

7.3%

Worse

Net Profit Margin

0.89%

6.3%

3.5%

Worse

Return on Assets

0.6%

7.6%

4.7%

Worse

Return on Equity

1.4%

15.3%

13.0%

Worse

Recommendations The company has an average position that in 2004 it is in worse condition but in 2005 again it become in stable position but again it gone to worse condition in 2006. The recommendations which can help this company are as follows: ♦ As the short term solvency ratios of this company are in worse condition so the company should payoff his liabilities so that it is in position to maintain its current ratio, quick ratio, cash ratio and its working capital. ♦ The company should payoff his Liabilities to maintain its Debt Ratio and Debt to Equity Ratio and it should maintain its sales so that it can increase its Time Interest Earned. ♦ To maintain the inventory turnover the company should increase its sales so that it can maintain its Inventory Turnover, and it should also increase its net sales by offering discount to its customer to maintain its Fixed and Total Assets Turnover. ♦ The company should increase its net sales to maintain its Gross Profit Margin, Operating Profit Margin and Net Profit Margin, it should increase its sales to get more profit so that it is able to maintain its Return On Assets and Return on Equity.

Cross Sectional Graphical Representation 2004 2005 2006

By seeing overall results of 2004, 2005 and 2006, in cross sectional analysis, company performance is better in 2005 then 2004 and 2006.

Time Series Graphical Representation 50 40 30 20 10 0

2004

2005

2006

By seeing overall results of 2004, 2005 and 2006, in time series analysis, company performance is better in 2005 then 2004 and 2006.

About a company; The company which is being selected for this report is

Kohinoor Sugar Mills Ltd. FAROOQ AHMED is a company secretary. Its registered office is in 29 – G, GULBERG – II, LAHORE and mills are in JAUHARABAD, DISTRICT KHUSHAB. STATEMENT OF ETHICS AND BUSINESS PRACTICE Code of ethics is a pre-requisite for all directors and employees of Kohinoor Sugar Mills Limited. We endeavor to have fully groomed employees committed to carry out honestly activities assigned to them. Our aim is to have high standard of excellence for the products and for all those involved with our Company. VISION STATEMENT To become a market leader in the Industry setting out high quality standards for the Company and others to follow. MISSION STATEMENT To produce/manufacture quality sugar and molasses by maintaining a high standard of efficiency and staying competitive to ensure customer satisfaction and to provide a comfortable level of return to all stakeholders.

Financial statement analysis: It is a set of four related accounting reports which shows the position and results of operations of an entity during a particular period of time. It includes; • • • •

Income statement Balance sheet Statement of cash flows Statement of retained earning

Types of Analysis; 1. Cross sectional analysis 2. Time series analysis

Cross sectional analysis: Financial results of the firm are compared with the result of industry.

Time series analysis: Evaluation of the firm financial performance over time (using financial ratio analysis) is known as Time series analysis. We do this analysis to; • Know the strengths and weakness • Know the historical performance • Know the current financial position of firm

Related Documents

Ibf Presentation

May 2020 1

Ibf Presentation

June 2020 1

Ibf Report

June 2020 3

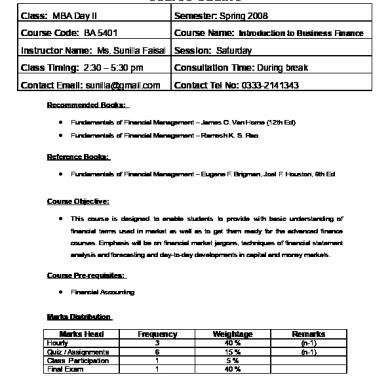

Ibf Course Outline Apr08

October 2019 10

Anti Flood Ibf

May 2020 2