Senator Jim Webb

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Senator Jim Webb as PDF for free.

More details

- Words: 829

- Pages: 3

-------- Original Message -------Subject: Senator Jim Webb's response to your message Date: Tue, 14 Oct 2008 12:07:25 -0400 From: Reply-To: To: October 14, 2008 Dear Mrs. Ward: Thank you for contacting my office regarding the turmoil in the financial markets that has compromised the solvency of several U.S. financial institutions and has threatened our nation's economy. I appreciate your taking the time to share your specific views and concerns. For many years, I have said that the current Administration has failed to exercise appropriate oversight of the nation's banking and corporate sectors, and has promoted policies that reward Wall Street at the expense of Main Street. The Administration's actions are largely responsible for our current economic crisis, which resulted in President Bush's September 2008 proposal to help restore soundness to U.S. credit markets. I opposed the original hastily-written and woefully inadequate financial sector bailout bill proposed by President Bush. In the nearly two weeks after the President's proposal, the U.S. Congress radically changed the original bill to better protect taxpayers and to ensure greater Congressional oversight. I am pleased that the bipartisan compromise legislation to stabilize our nation's economic system (H.R.1424), which the Senate passed on October 1, 2008 by a bipartisan vote of 74-25, bore no resemblance to the original Bush proposal. I understand the concerns raised by many Virginians about certain provisions of this legislation that may have been beyond the scope of the bill's intended purpose. However, I was not given the opportunity to offer amendments to the legislation, and as with any bipartisan initiative, compromise is necessary in order to advance our nation's priorities. After much deliberation, I voted to support the Senate's economic rescue legislation. I reached my decision based on the reality that this legislation provides the only possible opportunity that will be offered in the U.S. Congress this year to

address our nation's economic crisis. I am also satisfied that the significant recommendations I offered during the legislation's consideration were incorporated into the admittedly imperfect bill. Moreover, I was persuaded to support the Senate legislation because it provided meaningful tax relief to hardworking Virginia families and small businesses. Throughout the bill's negotiations, I was outspoken in support of several basic principles that are essential for the future economic well-being of our country. For example, I wrote a letter to Senate Banking Committee Chairman Chris Dodd only one day after U.S. Treasury Secretary Henry Paulson announced the original plan. spoke twice on the Senate floor about the proposal. Moreover, I led an

I

effort to convince the Senate Majority Leader to incorporate these principles in any legislation, including them in a letter that was co-signed by eight of my Senate colleagues. The fundamental principles that I raised included: A grave concern about the transfer of so much financial power and discretion to one individual in the executive branch of government, and the lack of a clear mechanism for the oversight of this unprecedented power; The need for proper limits on executive compensation, and a guarantee that the executives who mismanaged our financial markets not be unjustly enriched by a taxpayer bailout; The need for a guarantee that the American taxpayer be able to share directly in any benefits gained by the rescue legislation; Appropriate limits on the ability of foreign institutions to participate in the program; and The release of federal funds for the program in installments in order to ensure that Congress can properly fulfill its oversight role, and to give Congress time to enact meaningful new reforms to the regulatory structure. We were able to achieve significant progress in each of these areas. In particular, I am pleased that the Senate included meaningful provisions in the bill to limit executive compensation and to give taxpayers the chance to share in any gains achieved through

this legislation. These provisions will help to restore taxpayer confidence in our financial system and ease the credit crunch that threatens economic growth. The President signed the economic rescue legislation into law on October 3, 2008. Going forward, I will work aggressively with members of Congress from both sides of the aisle to ensure that this new law is implemented fairly, and in a way that safeguards the American taxpayer. Equally important, the next Congress must restore to our financial system a regulatory structure that will prevent this terrible chapter in American history from ever happening again. As Congress continues to address issues related to our nation's economy and the well-being of hardworking Virginians, please be assured that your specific views and suggestions will be very helpful to me and my staff. I hope that you will continue to share your thoughts with us in the years ahead. I would also invite you to visit my website at www.webb.senate.gov for regular updates about my activities and positions on matters that are important to Virginia and our nation. Sincerely, Jim Webb United States Senator JW:kw Please do not reply. This is not a working email address.

address our nation's economic crisis. I am also satisfied that the significant recommendations I offered during the legislation's consideration were incorporated into the admittedly imperfect bill. Moreover, I was persuaded to support the Senate legislation because it provided meaningful tax relief to hardworking Virginia families and small businesses. Throughout the bill's negotiations, I was outspoken in support of several basic principles that are essential for the future economic well-being of our country. For example, I wrote a letter to Senate Banking Committee Chairman Chris Dodd only one day after U.S. Treasury Secretary Henry Paulson announced the original plan. spoke twice on the Senate floor about the proposal. Moreover, I led an

I

effort to convince the Senate Majority Leader to incorporate these principles in any legislation, including them in a letter that was co-signed by eight of my Senate colleagues. The fundamental principles that I raised included: A grave concern about the transfer of so much financial power and discretion to one individual in the executive branch of government, and the lack of a clear mechanism for the oversight of this unprecedented power; The need for proper limits on executive compensation, and a guarantee that the executives who mismanaged our financial markets not be unjustly enriched by a taxpayer bailout; The need for a guarantee that the American taxpayer be able to share directly in any benefits gained by the rescue legislation; Appropriate limits on the ability of foreign institutions to participate in the program; and The release of federal funds for the program in installments in order to ensure that Congress can properly fulfill its oversight role, and to give Congress time to enact meaningful new reforms to the regulatory structure. We were able to achieve significant progress in each of these areas. In particular, I am pleased that the Senate included meaningful provisions in the bill to limit executive compensation and to give taxpayers the chance to share in any gains achieved through

this legislation. These provisions will help to restore taxpayer confidence in our financial system and ease the credit crunch that threatens economic growth. The President signed the economic rescue legislation into law on October 3, 2008. Going forward, I will work aggressively with members of Congress from both sides of the aisle to ensure that this new law is implemented fairly, and in a way that safeguards the American taxpayer. Equally important, the next Congress must restore to our financial system a regulatory structure that will prevent this terrible chapter in American history from ever happening again. As Congress continues to address issues related to our nation's economy and the well-being of hardworking Virginians, please be assured that your specific views and suggestions will be very helpful to me and my staff. I hope that you will continue to share your thoughts with us in the years ahead. I would also invite you to visit my website at www.webb.senate.gov for regular updates about my activities and positions on matters that are important to Virginia and our nation. Sincerely, Jim Webb United States Senator JW:kw Please do not reply. This is not a working email address.

Related Documents

Senator Jim Webb

November 2019 20

Open Letter To Senator Jim Webb

May 2020 6

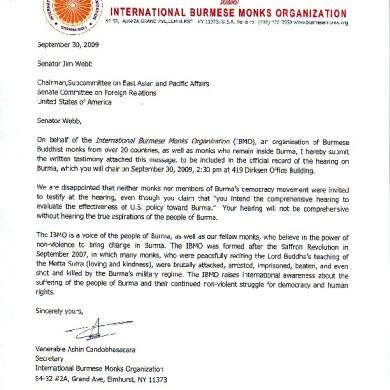

Ibmo Letter To Senator Jim Webb

June 2020 12

Meeting With Jim Webb

June 2020 5

Webb

October 2019 21