Nestle Report

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Nestle Report as PDF for free.

More details

- Words: 705

- Pages: 4

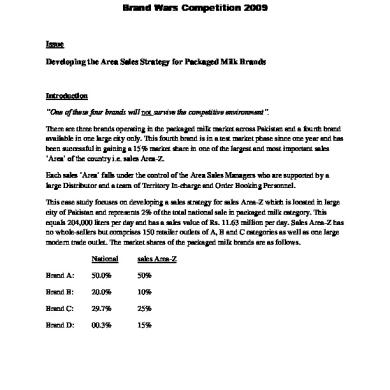

Brand Wars Competition 2009

Issue Developing the Area Sales Strategy for Packaged Milk Brands

Introduction “One of these four brands will not survive the competitive environment”. There are three brands operating in the packaged milk market across Pakistan and a fourth brand available in one large city only. This fourth brand is in a test market phase since one year and has been successful in gaining a 15% market share in one of the largest and most important sales ‘Area’ of the country i.e. sales Area-Z. Each sales ‘Area’ falls under the control of the Area Sales Managers who are supported by a large Distributor and a team of Territory In-charge and Order Booking Personnel. This case study focuses on developing a sales strategy for sales Area-Z which is located in large city of Pakistan and represents 2% of the total national sale in packaged milk category. This equals 204,000 liters per day and has a sales value of Rs. 11.63 million per day. Sales Area-Z has no whole-sellers but comprises 150 retailer outlets of A, B and C categories as well as one large modern trade outlet. The market shares of the packaged milk brands are as follows. National

sales Area-Z

Brand A:

50.0%

50%

Brand B:

20.0%

10%

Brand C:

29.7%

25%

Brand D:

00.3%

15%

The Business Situation; The sales teams of all the brands are in the process of designing their sales strategies and targets for 2010. They have the following key consideration. Research analysts have indicated that competition will become more aggressive in the packaged milk market. It is estimated that one of these four brands will lose its market share to competitors, will become un-profitable and will be forced to exit the Pakistan market by 2015. The ASM team for the sales Area-Z is faced with one of the most intense levels of competition as this is a strategically important market and represents 2% of the total market. Some of the recognized competitive pressures are listed as follows. 1. 2. 3. 4. 5. 6.

Stronger brand image and appeal Bigger/better retail network Higher levels of advertising Stronger product innovation Better dealer service Force of substitute products (powder milk, fresh milk, etc.)

From the distribution point of view, it is important to achieve the following 1. Improved numeric reach in the retail channel 2. Improved weighted reach in the retail channel 3. Higher share of shop

The retail channel audit shows that the reach of the brands in sales Area-Z is as follows.

Numeric reach

Weighted reach

Share of shop in big 13 outlets

Brand A:

80%

100%

60%

Brand B:

80%

100%

10%

Brand C:

100%

100%

10%

Brand D:

50%

100%

20%

The volume sold in sales Area-Z every day is 204,000 liters and its sales value is Rs. 11.63 million. The distributors cost for operating in the sales Area-Z is Rs. 15,000,000 per year and the distributor’s margin is 3% of the sales value. The investment made in the market in terms of cash ‘in circulation’ equals two day’s sales value. The ASMs are meeting with their teams to develop their sales targets for sales Area-Z. For this the team is conducting a SCAN and then will list down the market opportunities and threats in the market. They will use the 10-steps method to develop the sales strategy. The sales teams are aware that if their strategy is not strong enough then they could be the one who exits the market after failing. Preparation: Each ASM is preparing to meet their distributor for the next year’s plan. The ASM has the challenge to convince the distributor to agree to their strategy for growth in the market. Conducting the sales SCAN S = Sales environment

A = Account environment

C = Channel environment

N = Number Analysis

Key to SCAN Question to consider 1. What do we know about the Sales environment in the sales Area-Z? What are the competitive pressures for each brand? 2. What do we know about the retail Channel environment? Channel size, composition, etc.? 3. What do we know about the retail Account environment? The share of shop of the brands? 4. What do we know about the Numbers? Sales Volume or Value, etc.

Issue Developing the Area Sales Strategy for Packaged Milk Brands

Introduction “One of these four brands will not survive the competitive environment”. There are three brands operating in the packaged milk market across Pakistan and a fourth brand available in one large city only. This fourth brand is in a test market phase since one year and has been successful in gaining a 15% market share in one of the largest and most important sales ‘Area’ of the country i.e. sales Area-Z. Each sales ‘Area’ falls under the control of the Area Sales Managers who are supported by a large Distributor and a team of Territory In-charge and Order Booking Personnel. This case study focuses on developing a sales strategy for sales Area-Z which is located in large city of Pakistan and represents 2% of the total national sale in packaged milk category. This equals 204,000 liters per day and has a sales value of Rs. 11.63 million per day. Sales Area-Z has no whole-sellers but comprises 150 retailer outlets of A, B and C categories as well as one large modern trade outlet. The market shares of the packaged milk brands are as follows. National

sales Area-Z

Brand A:

50.0%

50%

Brand B:

20.0%

10%

Brand C:

29.7%

25%

Brand D:

00.3%

15%

The Business Situation; The sales teams of all the brands are in the process of designing their sales strategies and targets for 2010. They have the following key consideration. Research analysts have indicated that competition will become more aggressive in the packaged milk market. It is estimated that one of these four brands will lose its market share to competitors, will become un-profitable and will be forced to exit the Pakistan market by 2015. The ASM team for the sales Area-Z is faced with one of the most intense levels of competition as this is a strategically important market and represents 2% of the total market. Some of the recognized competitive pressures are listed as follows. 1. 2. 3. 4. 5. 6.

Stronger brand image and appeal Bigger/better retail network Higher levels of advertising Stronger product innovation Better dealer service Force of substitute products (powder milk, fresh milk, etc.)

From the distribution point of view, it is important to achieve the following 1. Improved numeric reach in the retail channel 2. Improved weighted reach in the retail channel 3. Higher share of shop

The retail channel audit shows that the reach of the brands in sales Area-Z is as follows.

Numeric reach

Weighted reach

Share of shop in big 13 outlets

Brand A:

80%

100%

60%

Brand B:

80%

100%

10%

Brand C:

100%

100%

10%

Brand D:

50%

100%

20%

The volume sold in sales Area-Z every day is 204,000 liters and its sales value is Rs. 11.63 million. The distributors cost for operating in the sales Area-Z is Rs. 15,000,000 per year and the distributor’s margin is 3% of the sales value. The investment made in the market in terms of cash ‘in circulation’ equals two day’s sales value. The ASMs are meeting with their teams to develop their sales targets for sales Area-Z. For this the team is conducting a SCAN and then will list down the market opportunities and threats in the market. They will use the 10-steps method to develop the sales strategy. The sales teams are aware that if their strategy is not strong enough then they could be the one who exits the market after failing. Preparation: Each ASM is preparing to meet their distributor for the next year’s plan. The ASM has the challenge to convince the distributor to agree to their strategy for growth in the market. Conducting the sales SCAN S = Sales environment

A = Account environment

C = Channel environment

N = Number Analysis

Key to SCAN Question to consider 1. What do we know about the Sales environment in the sales Area-Z? What are the competitive pressures for each brand? 2. What do we know about the retail Channel environment? Channel size, composition, etc.? 3. What do we know about the retail Account environment? The share of shop of the brands? 4. What do we know about the Numbers? Sales Volume or Value, etc.

Related Documents

Nestle Report

June 2020 8

Nestle Report

June 2020 6

Nestle Final Project Report

May 2020 12

Resource Nestle Annual Report

November 2019 4

Nestle

June 2020 9