Difference Between Islamic And Conventional Insurance

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Difference Between Islamic And Conventional Insurance as PDF for free.

More details

- Words: 2,192

- Pages: 6

Difference Between Islamic & Conventional Insurance____________________________ (1)

DIFFERENCE BETWEEN ISLAMIC INSURANCE (TAKAFUL) & CONVENTIONAL INSURANCE: MUHAMMAD ASGHAR SHAHZAD [email protected] [email protected]

WHAT IS INSURANCE? The law of insurance is contained in the insurance ordinance 2000. It extends to the whole of Pakistan. The securities and exchange commission of Pakistan will implement the law. Insurance is a means to spread the loss caused by particular risk over a number of people against some amount called premium. Insurance creates a fund under which many persons contribute some money called the premium, out of which the persons who suffer losses are compensated.

Definition of Insurance: “A contract of insurance is contract in which one party undertakes, against premium, to pay to the other party a certain amount on the happening of a certain event. A contract of insurance is a conditional contract. The general principles of the law of contract apply to it. It is a valid contract. It comes into existence by the offer in the form of proposal and its acceptance. The object of the contract must not be immoral or illegal.” Parties involved in Insurance: 1. Insurer 2. Insured Insurer: The party which promises to pay to certain sum of money to the other party is called the insurer (insurance company). Insured: The party of whom a certain some of money is paid is called the insured (Policy-holder)1

Explanation: 1

Cheema, Khalid Mahmood, Business Law, Published by Syed mobin Mahmud & co, Lahore, 2007, page# 368

Difference Between Islamic & Conventional Insurance____________________________ (2)

Insurance is a risk transfer mechanism hereby the individual or the business enterprise can shift some of the uncertainties of life on the healthier, comfortable and easy life to meet this requirement different enterprises produce and provide goods and services. They make innovation and invention, which take great risk. Large responsibility falls on the shoulder of innovators and inventors. A small error or lapse may cause numerous side effects and cause death or disability. These types of risks highlight the importance of insurance. If there had not been insurance at the back of all innovators the world would have never progressed. After assuring this in security factor the enterprises started looking for new and more high-tech machines robots and gargets, atomic technology, space traveling computers, deep sea exploration, development of concords and jumbos and medical technology for hydro hear led diseases. All these developments could be possible with support of insurance. In peace the insurance provides protection to trade and industry, which ultimately contributes towards human progress. Thus insurance is the most lending force contributing towards economics, social and technological progress of man. Without insurance cover all industrial, economic and social activity of the world will come to a grinding halt. An insurer, by nature, tries too split and diversify its risks in many ways a very important way is to split them horizontally and vertically within reinsurance companies and horizontally to their competitors. The following principles apply in insurance: • Insurable Interest. • Utmost good faith • Proximate cause • Indemnity • Contribution • Subrogation The insurance market comprises the following types of insurers: • Lloyds. • Ordinary Life & General Companies • Industrial Life Assurance companies • Friendly societies • Mutual Indemnity Associations • Captive Insurance companies • Self Insurance • The State. The premium received goes into a fund or pool from which the claims are paid. Because of large number of clients in any particular fund or pool, the insurers can predict, with reasonable accuracy by applying the law of large numbers and actuarial calculation methods, the amount of claims likely to be incurred in the coming year. However, there will be some variation in claim costs from year to year for which a small margin is to be built up in reserve. As a result of better performance of insurance company some benefit is paid back to the policyholders in shape of bonus in life insurance and no claim bonus is motor/property insurance.

HOW INSURANCE IS AGAINST THE PRINCIPLES OF SHARIAH?

Difference Between Islamic & Conventional Insurance____________________________ (3)

Commercial Insurance and all its contracts are relatively new development. The pioneer muslims neither knew it nor was it ever considered by the earlier Islamic Jurisprudents. It was for the first time examined by a Hanafi Jurist syed Ibn Abdin (dead 1252 H corresponding to 1836 A.D.) at the request of some muslim merchants who sought his poinion about the validity of marine insurance under Islamic laws. He discussed the essence of marine insurance and concluded” I see that it is not permitted to any merchant to get indemnity for his damaged property against the payment of a certain sum of money known as insurance premium; because this is a commitment for what should not be committed to.” The attitude towards illegality of insurance from Islamic point of view continued for full century after ibn Abdin. However in view of the tremendous importance assumed by insurance for the modern finance, trade and industry the contract of insurance has been subject matter of extensive and in depth studies and discussions amongst the Islamic Jurisprudents during the past several decades. In 1396 H (1976) the first international conference on Islamic Economics was held in Makkah, which was attended by more that 200 Islamic Jurists and Economists. They reached at the following decision on it: “The conference sees that the commercial insurance which is practiced by the commercial insurance companies in this era does not conform to the shariah principle of cooperation and solidarity because it does not fulfill the shariah conditions which would make it valid and acceptable”. This conference also suggested that a committee comprising of shariah Experts & Muslim Economists should be constituted in order to suggest a system of insurance that will be free of “Riba”., Usury and gharar the matter continued to receive the attention of numerous groups of Islamic Jurisprudents in cooperation with eminent and distinguished economists and insurance experts who came up with different conclusion, views and opinions. Some of them approved all forms of insurance subject to certain conditions, limitations and qualifications, others totally disapproved all of them. However an overwhelming majority of Islamic shariah. The objection is against the existence of the weaknesses in the insurance contract namely: • • •

Gharar (Uncertainry); Mainsir (Gambling); Riba (Usury).

Introduction to Islamic Insurance (Takaful): Muslim jurists acknowledge that the basis of shared responsibility in the system of "aquila" as practiced between Muslims of Mecca and Medina laid the foundation of mutual insurance. Islamic insurance was established in the early second century of the Islamic era when Muslim Arabs expanding trade into Asia mutually agreed to contribute to a fund to cover anyone in the group that incurred mishaps or robberies along the numerous sea voyages (marine insurance). Takaful Insurance

Difference Between Islamic & Conventional Insurance____________________________ (4)

Takaful is an Arabic word meaning “guaranteeing each other” or joint guarantee. The Tabarru' system is the main core of the takaful system making it free from uncertainty and gambling. Tabarru' means "donation; gift; contribution." Each participant that needs protection must be present with the sincere intention to donate to other participants faced with difficulties. Therefore, Islamic insurance exists where each participant contributes into a fund that is used to support one another with each participant contributing sufficient amounts to cover expected claims. The objective of takaful is to pay a defined loss from a defined fund. Muslim jurists conclude that insurance in Islam should be based on principles of mutuality and cooperation. Encompassing the elements of shared responsibility, joint indemnity, common interest and solidarity. The principles of Takaful insurance are as follows: • • • • •

Policyholders cooperate among themselves for their common good. Every policyholder pays his subscription to help those that need assistance. Losses are divided and liabilities spread according to the community pooling system. Uncertainty is eliminated in respect of subscription and compensation. It does not derive advantage at the cost of others.

Theoretically, Takaful is perceived as cooperative insurance, where members contribute a certain sum of money to a common pool. The purpose of this system is not profits but to uphold the principle of “bear ye one another’s burden.” “Commercial insurance is originally haram as agreed upon by most contemporary scholars. It is well known that in most non-Islamic countries there are cooperative and mutual insurance companies. There is no harm from the Shari`ah point of view to participate in these services. So, it is unlawful for a Muslim living in a country where there is such a cooperative insurance company to make an agreement with a commercial insurance company. But, if a cooperative insurance company is not found one may enter into a contract with a commercial insurance company only by way of necessity. If a person is forced by law to insurance or by way of need, it is obligatory for him to be content with the minimum proportion of insurance that covers his need or to the minimum of such transaction he’s being forced to carry out.” - European Council for Fatwa and Research2 Definition of Islamic Insurance (Takaful): The word Takaful is derived from the Arabic verb Kafala, which means to guarantee; to help; to take care of one’s needs. Takaful is a system of Islamic insurance based on the principle of Ta’awun (mutual assistance) and Tabarru (voluntary contribution), where risk is shared collectively by a group of participants, who by paying contributions to a common fund, agree to jointly guarantee themselves against loss or damage to

2

http://www.icmif.org/services/takaful/about.asp , Date 11, Aug 2008

Difference Between Islamic & Conventional Insurance____________________________ (5) any one of them as defined in the pact. Takaful is operated on the basis of shared responsibility, brotherhood, solidarity and mutual cooperation.

Fatwa on Takaful: The Islamic Fiqh Academy emanating from the Organization of Islamic conference, meeting in its Second Session in Jeddah, Saudi Arabia, from 10 to 16 Rabiul Thani, 1406 H (corresponding to 22-28 December, 1985) issued a resolution which in summary stated the following: • • • •

After reviewing the presentations made by participating scholars during the session on the subject of ‘Insurance/Re-insurance’; And after discussing the same; And after closely examining all types and forms of insurance and deeply examining the basic principles upon which the are founded and their goals and objectives; And having looked into what has been issued by the Fiqh Academies and other instituitions in ths regard;

Resolves: 1. The commercial insurance contract…is prohibited (Haraam) according to the Shariah. 2. The alternative contract which conforms to the principle of Islamic dealings is the contract of cooperative insurance (Takaful), which is founded on the basis of charitable donation and Shariah compliant dealings. Muslim jurists therefore concluded that: • • • •

Insurance should be based on the principles of mutuality and cooperation. Insurance products should be founded on the basis of Tabarru, an Arabic noun meaning ‘donation, gift, contribution’. The insurance company must conduct all its affairs in line with the Shariah The participants mutually contribute to the same fund for the purpose of mutual indemnity in case of risk and harm. 3

Difference between Insurance & Takaful 1. It is a Risk Transfer mechanism whereby risk is transferred from the policy holder (the Insured) to the Insurance Company (the Insurer) in consideration of 'insurance premium' paid by the Insured.

3

http://www.takaful.com.pk/Fatwa.html

Difference Between Islamic & Conventional Insurance____________________________ (6) It is based on mutuality; hence the risk is not transferred but shared by the participants who form a common pool. The Company acts only as the manager of the pool (Takaful Operator). 2. It contains the element of uncertainty i.e. "gharrar" which is forbidden in Islam. There is an uncertainty as to when any loss would occur and how much compensation would be payable. The element of 'uncertainty' i.e. 'gharrar' isbrought down to acceptable levels under Shariah by making contributions as "Conditional Donations" (tabarru) for a good cause i.e. to mitigate the loss suffered by any one of the participants. 3. It contains an element of gambling i.e. "maisir" in that the insured pays an amount (premium) in the expectation of gain (compensation/payment against claim). If the anticipated loss (claim) does not occur, the insured loses the amount paid as premium. If the loss does occur, the insurer loses a far larger amount than collected as premium and the insured gains by the same. The participant pays the contribution (tabarru) in the spirit of Ne'ea (purity) and brotherhood; hence it obviates the element of 'maisir' while at the same time without losing the benefit of Takaful in the same way as conventional insurance. 4. Funds are mostly invested in fixed interest bearing instruments like bonds, TFCs, securities, etc. Hence these contain the element of "riba" (usury) which is forbidden in Islam. Funds are only invested in non-interest bearing, i.e. riba-free instruments. 5. Surplus or profit belongs to the Shareholders. The insured is covered during the policy period but is not entitled to any return at the end of such period. Surplus belongs to the participants and is accordingly returned to them (in proportion to their respective shares of contributions) at the end of the accounting period

DIFFERENCE BETWEEN ISLAMIC INSURANCE (TAKAFUL) & CONVENTIONAL INSURANCE: MUHAMMAD ASGHAR SHAHZAD [email protected] [email protected]

WHAT IS INSURANCE? The law of insurance is contained in the insurance ordinance 2000. It extends to the whole of Pakistan. The securities and exchange commission of Pakistan will implement the law. Insurance is a means to spread the loss caused by particular risk over a number of people against some amount called premium. Insurance creates a fund under which many persons contribute some money called the premium, out of which the persons who suffer losses are compensated.

Definition of Insurance: “A contract of insurance is contract in which one party undertakes, against premium, to pay to the other party a certain amount on the happening of a certain event. A contract of insurance is a conditional contract. The general principles of the law of contract apply to it. It is a valid contract. It comes into existence by the offer in the form of proposal and its acceptance. The object of the contract must not be immoral or illegal.” Parties involved in Insurance: 1. Insurer 2. Insured Insurer: The party which promises to pay to certain sum of money to the other party is called the insurer (insurance company). Insured: The party of whom a certain some of money is paid is called the insured (Policy-holder)1

Explanation: 1

Cheema, Khalid Mahmood, Business Law, Published by Syed mobin Mahmud & co, Lahore, 2007, page# 368

Difference Between Islamic & Conventional Insurance____________________________ (2)

Insurance is a risk transfer mechanism hereby the individual or the business enterprise can shift some of the uncertainties of life on the healthier, comfortable and easy life to meet this requirement different enterprises produce and provide goods and services. They make innovation and invention, which take great risk. Large responsibility falls on the shoulder of innovators and inventors. A small error or lapse may cause numerous side effects and cause death or disability. These types of risks highlight the importance of insurance. If there had not been insurance at the back of all innovators the world would have never progressed. After assuring this in security factor the enterprises started looking for new and more high-tech machines robots and gargets, atomic technology, space traveling computers, deep sea exploration, development of concords and jumbos and medical technology for hydro hear led diseases. All these developments could be possible with support of insurance. In peace the insurance provides protection to trade and industry, which ultimately contributes towards human progress. Thus insurance is the most lending force contributing towards economics, social and technological progress of man. Without insurance cover all industrial, economic and social activity of the world will come to a grinding halt. An insurer, by nature, tries too split and diversify its risks in many ways a very important way is to split them horizontally and vertically within reinsurance companies and horizontally to their competitors. The following principles apply in insurance: • Insurable Interest. • Utmost good faith • Proximate cause • Indemnity • Contribution • Subrogation The insurance market comprises the following types of insurers: • Lloyds. • Ordinary Life & General Companies • Industrial Life Assurance companies • Friendly societies • Mutual Indemnity Associations • Captive Insurance companies • Self Insurance • The State. The premium received goes into a fund or pool from which the claims are paid. Because of large number of clients in any particular fund or pool, the insurers can predict, with reasonable accuracy by applying the law of large numbers and actuarial calculation methods, the amount of claims likely to be incurred in the coming year. However, there will be some variation in claim costs from year to year for which a small margin is to be built up in reserve. As a result of better performance of insurance company some benefit is paid back to the policyholders in shape of bonus in life insurance and no claim bonus is motor/property insurance.

HOW INSURANCE IS AGAINST THE PRINCIPLES OF SHARIAH?

Difference Between Islamic & Conventional Insurance____________________________ (3)

Commercial Insurance and all its contracts are relatively new development. The pioneer muslims neither knew it nor was it ever considered by the earlier Islamic Jurisprudents. It was for the first time examined by a Hanafi Jurist syed Ibn Abdin (dead 1252 H corresponding to 1836 A.D.) at the request of some muslim merchants who sought his poinion about the validity of marine insurance under Islamic laws. He discussed the essence of marine insurance and concluded” I see that it is not permitted to any merchant to get indemnity for his damaged property against the payment of a certain sum of money known as insurance premium; because this is a commitment for what should not be committed to.” The attitude towards illegality of insurance from Islamic point of view continued for full century after ibn Abdin. However in view of the tremendous importance assumed by insurance for the modern finance, trade and industry the contract of insurance has been subject matter of extensive and in depth studies and discussions amongst the Islamic Jurisprudents during the past several decades. In 1396 H (1976) the first international conference on Islamic Economics was held in Makkah, which was attended by more that 200 Islamic Jurists and Economists. They reached at the following decision on it: “The conference sees that the commercial insurance which is practiced by the commercial insurance companies in this era does not conform to the shariah principle of cooperation and solidarity because it does not fulfill the shariah conditions which would make it valid and acceptable”. This conference also suggested that a committee comprising of shariah Experts & Muslim Economists should be constituted in order to suggest a system of insurance that will be free of “Riba”., Usury and gharar the matter continued to receive the attention of numerous groups of Islamic Jurisprudents in cooperation with eminent and distinguished economists and insurance experts who came up with different conclusion, views and opinions. Some of them approved all forms of insurance subject to certain conditions, limitations and qualifications, others totally disapproved all of them. However an overwhelming majority of Islamic shariah. The objection is against the existence of the weaknesses in the insurance contract namely: • • •

Gharar (Uncertainry); Mainsir (Gambling); Riba (Usury).

Introduction to Islamic Insurance (Takaful): Muslim jurists acknowledge that the basis of shared responsibility in the system of "aquila" as practiced between Muslims of Mecca and Medina laid the foundation of mutual insurance. Islamic insurance was established in the early second century of the Islamic era when Muslim Arabs expanding trade into Asia mutually agreed to contribute to a fund to cover anyone in the group that incurred mishaps or robberies along the numerous sea voyages (marine insurance). Takaful Insurance

Difference Between Islamic & Conventional Insurance____________________________ (4)

Takaful is an Arabic word meaning “guaranteeing each other” or joint guarantee. The Tabarru' system is the main core of the takaful system making it free from uncertainty and gambling. Tabarru' means "donation; gift; contribution." Each participant that needs protection must be present with the sincere intention to donate to other participants faced with difficulties. Therefore, Islamic insurance exists where each participant contributes into a fund that is used to support one another with each participant contributing sufficient amounts to cover expected claims. The objective of takaful is to pay a defined loss from a defined fund. Muslim jurists conclude that insurance in Islam should be based on principles of mutuality and cooperation. Encompassing the elements of shared responsibility, joint indemnity, common interest and solidarity. The principles of Takaful insurance are as follows: • • • • •

Policyholders cooperate among themselves for their common good. Every policyholder pays his subscription to help those that need assistance. Losses are divided and liabilities spread according to the community pooling system. Uncertainty is eliminated in respect of subscription and compensation. It does not derive advantage at the cost of others.

Theoretically, Takaful is perceived as cooperative insurance, where members contribute a certain sum of money to a common pool. The purpose of this system is not profits but to uphold the principle of “bear ye one another’s burden.” “Commercial insurance is originally haram as agreed upon by most contemporary scholars. It is well known that in most non-Islamic countries there are cooperative and mutual insurance companies. There is no harm from the Shari`ah point of view to participate in these services. So, it is unlawful for a Muslim living in a country where there is such a cooperative insurance company to make an agreement with a commercial insurance company. But, if a cooperative insurance company is not found one may enter into a contract with a commercial insurance company only by way of necessity. If a person is forced by law to insurance or by way of need, it is obligatory for him to be content with the minimum proportion of insurance that covers his need or to the minimum of such transaction he’s being forced to carry out.” - European Council for Fatwa and Research2 Definition of Islamic Insurance (Takaful): The word Takaful is derived from the Arabic verb Kafala, which means to guarantee; to help; to take care of one’s needs. Takaful is a system of Islamic insurance based on the principle of Ta’awun (mutual assistance) and Tabarru (voluntary contribution), where risk is shared collectively by a group of participants, who by paying contributions to a common fund, agree to jointly guarantee themselves against loss or damage to

2

http://www.icmif.org/services/takaful/about.asp , Date 11, Aug 2008

Difference Between Islamic & Conventional Insurance____________________________ (5) any one of them as defined in the pact. Takaful is operated on the basis of shared responsibility, brotherhood, solidarity and mutual cooperation.

Fatwa on Takaful: The Islamic Fiqh Academy emanating from the Organization of Islamic conference, meeting in its Second Session in Jeddah, Saudi Arabia, from 10 to 16 Rabiul Thani, 1406 H (corresponding to 22-28 December, 1985) issued a resolution which in summary stated the following: • • • •

After reviewing the presentations made by participating scholars during the session on the subject of ‘Insurance/Re-insurance’; And after discussing the same; And after closely examining all types and forms of insurance and deeply examining the basic principles upon which the are founded and their goals and objectives; And having looked into what has been issued by the Fiqh Academies and other instituitions in ths regard;

Resolves: 1. The commercial insurance contract…is prohibited (Haraam) according to the Shariah. 2. The alternative contract which conforms to the principle of Islamic dealings is the contract of cooperative insurance (Takaful), which is founded on the basis of charitable donation and Shariah compliant dealings. Muslim jurists therefore concluded that: • • • •

Insurance should be based on the principles of mutuality and cooperation. Insurance products should be founded on the basis of Tabarru, an Arabic noun meaning ‘donation, gift, contribution’. The insurance company must conduct all its affairs in line with the Shariah The participants mutually contribute to the same fund for the purpose of mutual indemnity in case of risk and harm. 3

Difference between Insurance & Takaful 1. It is a Risk Transfer mechanism whereby risk is transferred from the policy holder (the Insured) to the Insurance Company (the Insurer) in consideration of 'insurance premium' paid by the Insured.

3

http://www.takaful.com.pk/Fatwa.html

Difference Between Islamic & Conventional Insurance____________________________ (6) It is based on mutuality; hence the risk is not transferred but shared by the participants who form a common pool. The Company acts only as the manager of the pool (Takaful Operator). 2. It contains the element of uncertainty i.e. "gharrar" which is forbidden in Islam. There is an uncertainty as to when any loss would occur and how much compensation would be payable. The element of 'uncertainty' i.e. 'gharrar' isbrought down to acceptable levels under Shariah by making contributions as "Conditional Donations" (tabarru) for a good cause i.e. to mitigate the loss suffered by any one of the participants. 3. It contains an element of gambling i.e. "maisir" in that the insured pays an amount (premium) in the expectation of gain (compensation/payment against claim). If the anticipated loss (claim) does not occur, the insured loses the amount paid as premium. If the loss does occur, the insurer loses a far larger amount than collected as premium and the insured gains by the same. The participant pays the contribution (tabarru) in the spirit of Ne'ea (purity) and brotherhood; hence it obviates the element of 'maisir' while at the same time without losing the benefit of Takaful in the same way as conventional insurance. 4. Funds are mostly invested in fixed interest bearing instruments like bonds, TFCs, securities, etc. Hence these contain the element of "riba" (usury) which is forbidden in Islam. Funds are only invested in non-interest bearing, i.e. riba-free instruments. 5. Surplus or profit belongs to the Shareholders. The insured is covered during the policy period but is not entitled to any return at the end of such period. Surplus belongs to the participants and is accordingly returned to them (in proportion to their respective shares of contributions) at the end of the accounting period

Related Documents

Islamic Insurance And Investment

May 2020 7

Islamic Vs Conventional

June 2020 4

Difference Between Linux And Windows

November 2019 36

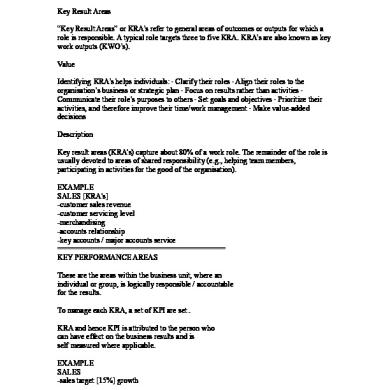

Difference Between Kra And Kpa

October 2019 23