Cheat Sheet.pdf

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA

Overview

Download & View Cheat Sheet.pdf as PDF for free.

More details

- Words: 276

- Pages: 48

REVIEW SHEET FINANCIAL ACCOUNTING BY CHRISTINE PELLETIER

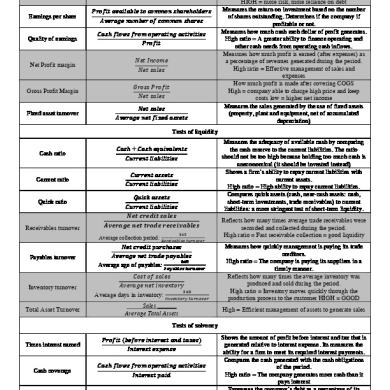

! RATIOS Debt-to-equity

Return on

How the cie. finance its assets equity Risk assumed because of debt How much sales per $ financing of assets Whether they should expend

Liabilities Shareholder’s equity

Profit Shareholder’s equity

Total asset turnover

Profit margin

How much sales per $ of assets

Net sales Average total assets

How much profit per $ of sale

Profit Net sales

Receivable turnover

Average collection period

Profit Average net trade receivable

365 ∆ receivable turnover

BANK RECONCILIATION PER BANK

PER BOOK

+ deposit in transit - outstanding cheque +- bank error = correct balance

+ deposit by bank - service charge - NSF cheque +- book error = correct balance

*Note that 2 most common adjustment are – NSF cheques and + bank charge fees BAD DEBT Allowance for bad = amount uncollectible – credit balance for allowance = end balance for allowance debt account (Contra-asset account) +XA, -A

Net value of trade = trade receivable – allowance for doubtful account receivable STATEMENT INCOME Revenue Sales revenue Sales return Net revenue Cost of good sold *Gross profit Expense Wage Depreciation Operating expense Total expense *Operating profit Other income/expense Rent revenue Interest income Interest expense *Profit before income tax Income tax expense *Profit Earning per share

FINANCIAL POSITION Current Asset Cash Trade receivable Inventory Note receivable Interest receivable Prepaid rent Total current asset

Current liabilities Trade payable Dividend payable Income tax payable Note payable Interest payable Deferred rent revenue Total current liabilities

Non-current asset Equipment Less accumulated depreciation Total asset

Shareholder’s equity Common shares Retained earnings (R.E. – dividend + profit) Total shareholder’s equity Total liabilities and shareholder’s equity

! RATIOS Debt-to-equity

Return on

How the cie. finance its assets equity Risk assumed because of debt How much sales per $ financing of assets Whether they should expend

Liabilities Shareholder’s equity

Profit Shareholder’s equity

Total asset turnover

Profit margin

How much sales per $ of assets

Net sales Average total assets

How much profit per $ of sale

Profit Net sales

Receivable turnover

Average collection period

Profit Average net trade receivable

365 ∆ receivable turnover

BANK RECONCILIATION PER BANK

PER BOOK

+ deposit in transit - outstanding cheque +- bank error = correct balance

+ deposit by bank - service charge - NSF cheque +- book error = correct balance

*Note that 2 most common adjustment are – NSF cheques and + bank charge fees BAD DEBT Allowance for bad = amount uncollectible – credit balance for allowance = end balance for allowance debt account (Contra-asset account) +XA, -A

Net value of trade = trade receivable – allowance for doubtful account receivable STATEMENT INCOME Revenue Sales revenue Sales return Net revenue Cost of good sold *Gross profit Expense Wage Depreciation Operating expense Total expense *Operating profit Other income/expense Rent revenue Interest income Interest expense *Profit before income tax Income tax expense *Profit Earning per share

FINANCIAL POSITION Current Asset Cash Trade receivable Inventory Note receivable Interest receivable Prepaid rent Total current asset

Current liabilities Trade payable Dividend payable Income tax payable Note payable Interest payable Deferred rent revenue Total current liabilities

Non-current asset Equipment Less accumulated depreciation Total asset

Shareholder’s equity Common shares Retained earnings (R.E. – dividend + profit) Total shareholder’s equity Total liabilities and shareholder’s equity

Related Documents

Cheat

October 2019 22

Cheat

November 2019 27

Cheat

May 2020 13

Cheat

June 2020 14

Cheat

December 2019 30

Cheat Harvestmon.txt

April 2020 4More Documents from "DenizJunarsa"

Ratios Comm217 Updated Lm.pdf

June 2020 1

Cheat Sheet.pdf

June 2020 1

Past Midterm.pdf

June 2020 2

Gh05=vector_plane_01.pdf

June 2020 3